I have a not-so-secret obsession with personal finance. I love to talk about taxes, retirement accounts, credit card points, etc.

I geek out on tracking our income and expenses. It sounds ridiculous, but I treat our personal finances like a business.

Around the 4th day of the month, I download the transaction summary for the prior month from 4 different accounts.

- Chase Checking (Dia)

- Amex Credit Card (Dia)

- Capital One Checking (Sun)

- Chase Credit Card (Sun)

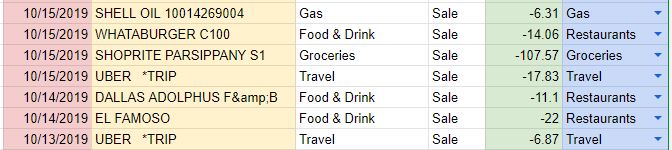

After I upload the latest month’s transactions for each account, I begin to categorize each transaction. We average about 125 transactions per month across all 4 accounts. Assigning categories to each line item is my favorite part.

- ShopRite / Costco is Grocery

- Wawa / Shell / Exxon is Gas

- Starbucks / Tito’s / Playa Bowls is Restaurant

- Amazon is Amazon, Target is Target

Each column is color coded so I can copy the raw data from each account’s worksheet into the master raw data tab easily.

- Dates are Red

- Descriptions are Yellow

- Amounts are Green

- Categories are Blue

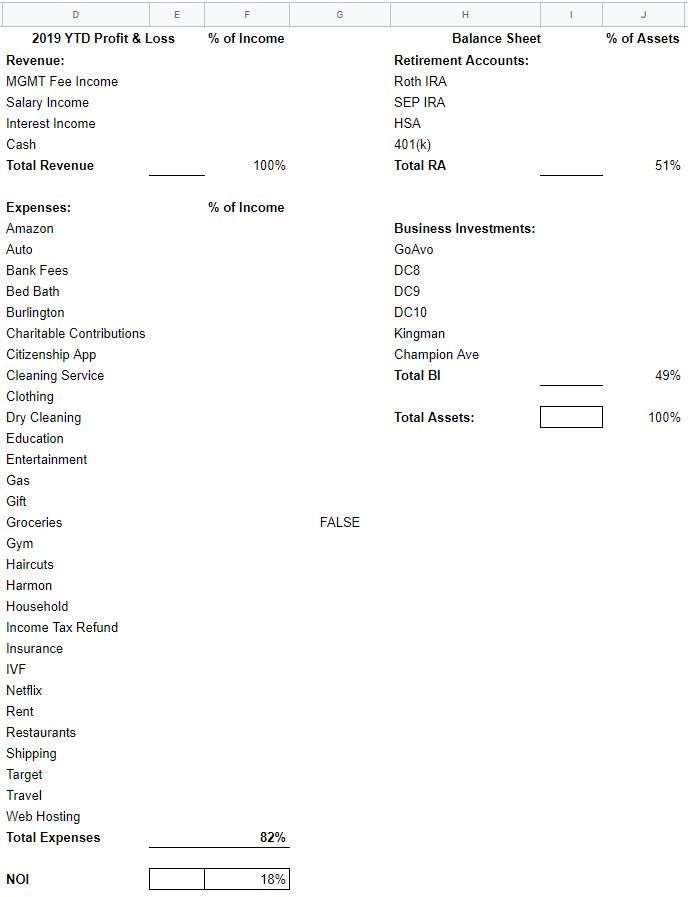

All of this data is then run through a pivot table that creates the following two reports.

- Year To Date Profit & Loss Statement

- Updated Balance Sheet

❓What Do These Two Reports Tell Me?

I’m looking for three things.

- Total Assets has to go up on a monthly basis. We currently don’t have any personal liabilities so our Total Assets = Net Worth. Tracking income and expenses is micro-economics. Tracking net worth is macro-economics. Both are important.

- Grocery Expense should be greater than Restaurant Expense. The “FALSE” next to groceries indicates that we are NOT succeeding. We go out to eat way too much.

- How “profitable” are we? At the end of October 2019, we were running at an 18% profit margin. Up until April 2019, we were running at a 45% margin. We paid for IVF in May and that was a heavy lift, but totally worth it.

After I run the reports, I send them to Dia with my notes. Along with my notes is a calendar invite for a meeting to discuss the good, the bad, and the ugly. Dia tells people she hates this part, but I’m convinced she secretly loves it.

Together, we answer the following 3 questions.

- Where are we spending money that doesn’t serve us well?

- What big expenses are coming up that we should keep in mind?

- Where do we want to spend more money?

The first two questions force us to stay accountable and vigilant. The last question lets us end on a happy note. We typically brainstorm restaurants to visit, trips to take, or experiences to book.

?A Few Guidelines

When it comes to personal finance, we operate by a handful of rules. Here they are in order of priority.

- Do everything possible to ethically minimize taxes.

- Automate Traditional Retirement Investing. We don’t want to work forever.

- Automate Charitable Contributions. Giving back is important to us.

- Optimize spending for happiness. Identify expenses that generate enjoyment. Do more of it. Identify expenses that cause regret or neutral feelings. Eliminate them.

I love spending on grabbing food with friends & family, educational material, and traveling. I’m really stingy when it comes to spending money on “stuff” like clothes, shoes, decorations, etc.

Dia loves buying a new outfit, cute shoes, or anything for her family back in Mexico. She tries to avoid spending money on me. I’ve made her return 99% of anything she’s ever bought me: Christmas & Birthday gifts included.

?Making It Easy

I did the entire process outlined above for the first 10 months of 2019. In November 2019, I switched back to using Personal Capital.

Personal Capital is an app that makes tracking your finances super easy. It connects with all of your accounts and automatically categorizes transactions based on their description. They provide charts that show your net worth, cash flow, and actual expenses against a predetermined budget. I don’t love the idea of budgeting, so I don’t pay too close attention to that part of it.

We originally started using Personal Capital to track our finances in 2018. I wanted to move away from it for 2019 because it was too easy and I didn’t feel “involved” enough. The app did too much of the grunt-work for me. I needed to take control for a while before going back.

Taking control allowed me to build a system of tracking, reviewing, analyzing, and reporting my findings to Dia. Now that the monthly routine is fixed, I’m going to outsource the tracking part back to Personal Capital.

I still plan on going through each transaction to categorize them even though most of them will be correctly pre-populated. Here’s an example of when Personal Capital’s auto assignment of category goes wrong.

The first Wawa charge should be “Gas”. The second I would consider as “Restaurant” since it was for Coffee.

❓How To Use Personal Capital:

- Click Here

- Sign up by creating an account with your email address.

- Connect your cash accounts – checking / saving

- Connect your credit accounts – if different than checking / saving bank

- Connect your brokerage accounts – stocks, retirement, etc.

- Manually add any “Other Assets” – House, Car, etc.

- Connect your liability accounts – loans on house / car

Signing up and connecting all of your accounts will be enough for most people. If you want to get granular like me, you’ll want to click Overview → Transactions to make sure each line item is categorized correctly.

????Is Personal Capital for Everyone?

Personal Capital is for you if…

- You have an income

- You ever wondered where the hell your money went.

- You have multiple accounts across different banks / institutions

This app is free. If you make minimum wage or hundreds of dollars per hour, I think this is at least worth trying. It’s a great way to keep track of your financial dashboard over time.

?Set it & Forget it

You can set up your Personal Capital account today and not look at it again for a year. The data will still be there. You will be able to see how your cash flow and net worth progressed over time. The categories may not be completely accurate, but the numbers will be right.

This is probably my favorite part of the app. It’s not like other tracking apps where you have to input the data for it to work. It pulls the data from your online accounts.

However, some banks require a two-step verification every time you log into Personal Capital. This is kind of annoying and quite frankly making me think twice about moving my money out of Capital One. I appreciate the added security, but wish they’d figure out a more conveinent way.

The worst part of the app is…

?Planning & Management

Personal Capital provides this awesome app for free for one reason only. They want you to ultimately sign up for their Wealth Management services. Someone from the company calls me about once a quarter to “check-in and see how I’m doing”. I try to end the conversation before they pitch me.

They make their money by telling us what to invest in. This is where I draw the line. I don’t use their paid services and I don’t think anyone reading this needs to either.

?Empower Yourself – Learn to Invest

Use the Personal Capital app for tracking, reviewing, and analyzing your cash flow and net worth. If you want solid investing advice, I’d encourage you to read any of the following resources:

- Mr. Money Mustache blog

- The Simple Path to Wealth blog

- The Mad Fientist blog

- I Will Teach You To Be Rich blog / book

- Anything by John Bogle, Warren Buffet, or Charlie Munger.

Bogle, Buffet, & Munger are basically the GOATs of investing. I put these 3 guys at the bottom of the list because they typically don’t give any actual investing advice. They mostly share their mental models, which ultimately translates to better investing principles.

Here’s the TL;DR of investing: Time in the market is more important than timing the market. Start now, even if it’s only $5 per month. Automate investment contributions so you don’t have to think about it. Unless you have some sort of competitive advantage, choose Total Market Index Funds (VTSAX / FZROX) over individual stocks, ETFs, or mutual funds. Avoid fees.

✒Sign Up!

This app has been super helpful for us. As I did all the grunt-work myself over the first 10 months of 2019, Personal Capital ran in the background and the end results were the same.

I’m crazy, so I like to know where every penny goes. But you don’t have to be as anal as me to get massive value from signing up for this service. Try it out. Set it up. Give it a few months. See if it adds value to your life. Let me know how it goes.

P.S.

If you use the link provided in this writing to sign up & then connect a qualified investment account with more than $1,000 in it, we’ll both get a $20 Amazon Gift Card!

SUBSCRIBE NOW TOSUNSHAKSUNDAY

Join my newsletter if you want to learn more about real estate investing, personal finance, health & fitness, and so much more.