Kids are hella expensive!

Kids are hella expensive!

If you’re a new parent and you’re worried about the rising cost of education as well as providing for your child in general, I have the playbook for you.

Listen up!

According to the United States Department of Agriculture the cost of raising a child to the age of 18 is $233,610.

That’s $13,000 a year. Lotta money.

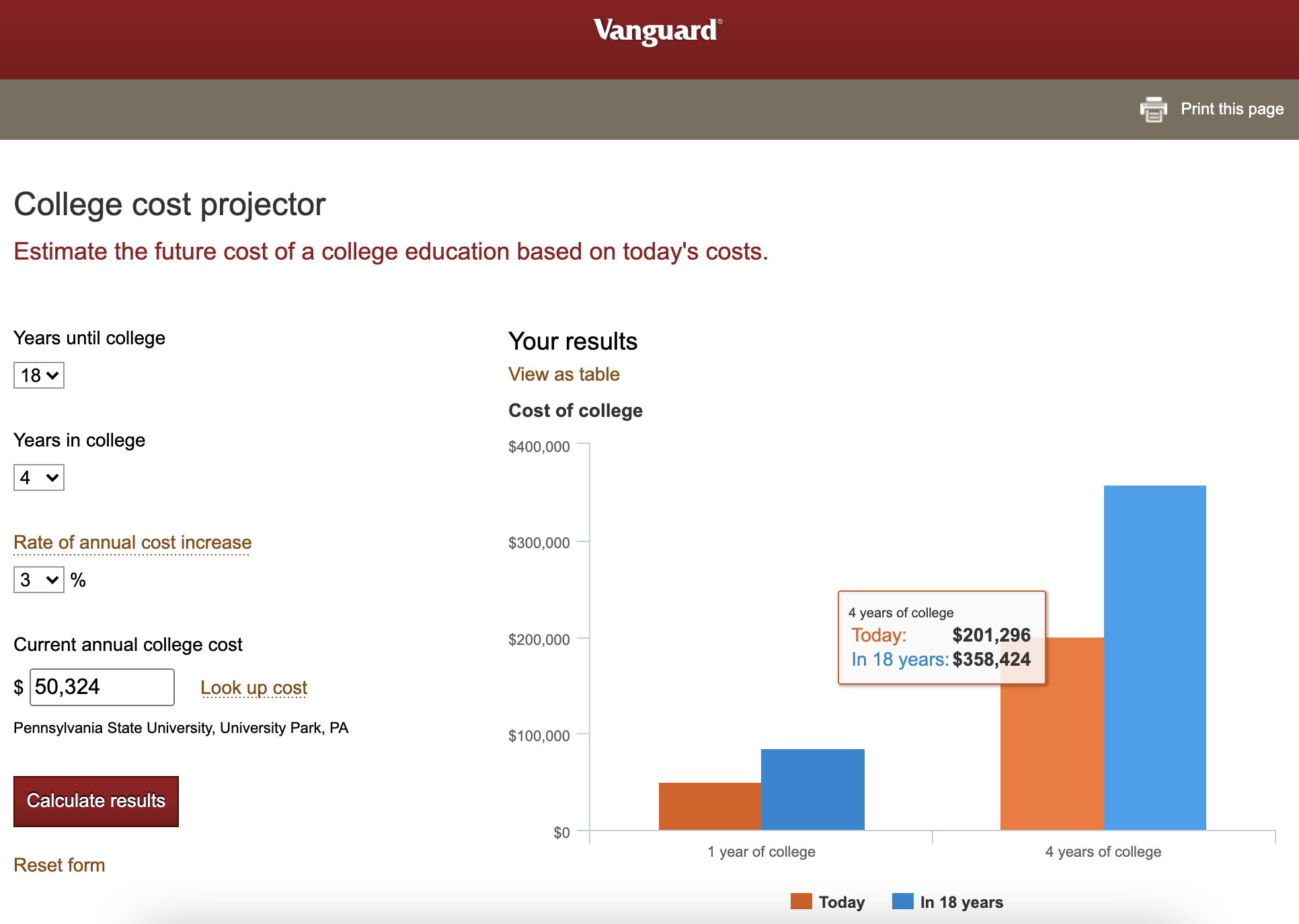

But that’s just the price of admission. If you want to get fancy and pay for their college, that can cost upwards of $350K.

At least that’s what it would cost me if my kid wants to go to the same school I went to 18 years from now.

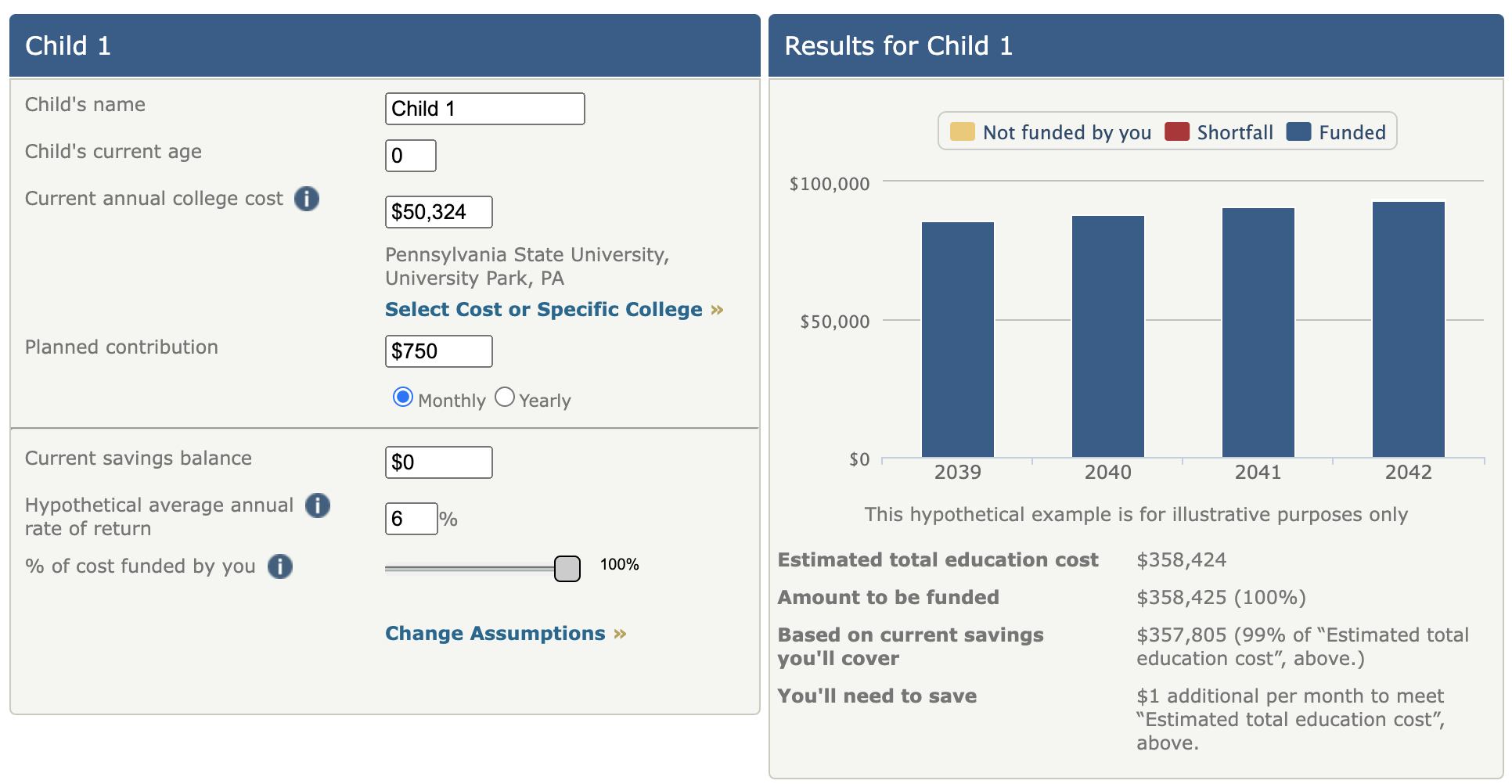

If I wanted to save up $350K in a 529 plan, I’d need to contribute $750 per month for 18 years and pray the market returns 6% per year.

$750 per month is an extra $9,000 per year or $162,000 over 18 years. That’s nuts!

I’m happy to tell you – there is!

We’ll go through how to solve the rising costs of raising children with two simple decisions.

The first decision is to swear off the 529 plan. Ain’t nobody got time to invest $750 per month for 18 years while trying to afford diapers, toys, and clothes for a tiny human.

The second step is to buy a small multifamily property with an FHA backed loan.

Find a 2-4 unit building that costs $400K and put 3.5% down. That’s about 15,000 bucks. Make sure the rent-roll when fully occupied is at least $4,000 per month. Finally, it should be in a condition and location you’re willing to live in because you have to owner-occupy the property for at least one year.

After one year, move out and let your tenants pay down your mortgage. If you buy right, you should have some extra cash flow every month to help subsidize the $13,000 per year you’ll be spending on your child.

After 18 years, the property value should increase and your tenants will have paid your principal down, allowing you to do a cash-out refi to pay for your children’s college tuition in cash.

When they’re 18 and you’re 50, you’ll refinance into another 30 year mortgage and enjoy some extra cash flow into your twilight years. When you die of old age, you’ll hand off a debt-free asset to your children or grandchildren and your dream of creating generational wealth will be complete.