I used to own a quick service restaurant franchise.

I used to own a quick service restaurant franchise.

We opened our doors to the public in 2014, and unceremoniously shut down the business in 2017.

Although we were only operational for 3 years, I signed a 10 year royalty agreement with the franchisor.

Naturally, a few months after we closed the business, the franchisor sued me for $60,449.91 to recover the royalties they would have collected over the remaining 7 years of my franchise agreement.

When I read that number in the demand letter, I couldn’t help but laugh.

There was absolutely no way I could afford to pay that amount.

And even if I could, there was no way I would hand over that kind of money to a franchise system that provided little to no support when I needed it most.

I knew they weren’t going to let me off the hook, so I had to prepare for battle.

I did take a negotiation course in college, but I needed a refresher so I bought a book called Never Split The Difference by Chris Voss.

After reading that book, I applied 9 tactics to negotiate that lawsuit down to a fraction of the original amount.

Time is Your Friend

Time is Your Friend

The first tactic I applied was “Time Is Your Friend.”

The franchisor originally sent a demand letter through a courier service.

I didn’t reply.

A month later, they sent another demand letter through certified mail.

I still didn’t reply.

Another month later they sent a final demand letter saying they were going to file a petition against me in court if I didn’t resolve this issue in the next 30 days.

I still didn’t reply.

They were trying to intimidate me and I wasn’t going to let them do that.

This was a game of chicken I refused to lose.

And waiting paid off.

About halfway through that third month, I received a call from the CEO.

In a 5 minute conversation over the phone, I had the opportunity to apply four more tactics from the book.

They were Mirroring, Labeling, Calibrated Questions, and Saying No Without Saying No.

Before we get to the actual conversation, let’s define these terms.

Mirroring

Mirroring

Mirroring is when you awkwardly repeat back the last thing someone says to you in an effort to pull more information out of them.

Labeling

Labeling

Labeling is a way of validating someone’s emotion by acknowledging it. Instead of denying or ignoring emotions, good negotiators identify and influence them because emotion can be used as a tool.

Calibrated Questions

Calibrated Questions

Calibrated Questions are open ended questions that don’t have fixed answers. They buy you time and give your counterpart the illusion of control. An example of a calibrated question is something like, “What’s the end goal here?” or How can we solve this problem?”

Saying No Without Saying No

Saying No Without Saying No

And finally, Saying No Without Saying No is simply using phrases like, “How am I supposed to do that?” or “How can you expect me to do that?”

The reason you don’t want to explicitly say the word No in a negotiation is because it makes your counterpart defensive. Saying No is like putting up a big brick wall. You’re effectively ending the conversation in its tracks.

OK now let’s jump into the conversation.

OK now let’s jump into the conversation.

As soon as I answered the phone, the CEO of the Franchise opened with,

“Hey Sunny, we’re getting ready to file a petition against you early next week. I just wanted you to hear it from me first”.

My reply was, “You wanted me to hear it from you first?”

All I did was repeat the last thing he said. He said it as a statement. I asked it as a question. That kept him talking.

He replied with, “Yeah, listen… we really want to settle this before it goes to court. It’s a headache to get our legal team involved.”

This is where I hit him with a combo. I labeled his emotions and followed up with a calibrated question.

I said, “It seems like you want to settle this quickly. How can we solve this problem?”

He said, “The company is willing to discount the claim amount by 50%. That way you’d only owe us about 30K. Are you comfortable with that?

I went back to mirroring him and tried saying no without saying no.

I said, “I’d be comfortable if this all went away. How do you feel about dropping this lawsuit altogether?”

He said he couldn’t drop it, but the offer stood until the end of the week.

We hung up the phone and lived to fight another day. That phone call was the last time I ever spoke to anyone from that franchise ever again. From that point on, we only communicated through our lawyers.

Although we didn’t come to a resolution on that phone call, I wouldn’t say it was a complete failure.

We got a 50% reduction to the total amount of the suit by simply (5) using time as our friend, mirroring, labeling, asking calibrated questions, and saying no without saying no.

About two weeks later, I received the lawsuit in the mail. It was a thick packet of documents.

I had 15 days to reply with an answer.

I immediately hired an attorney in Texas because that’s the state they were suing me in.

The attorney charged me a $5,000 retainer and agreed to bill me at $250 per hour.

We waited for the 15th day to file our answer with the court. We basically said we weren’t going to settle and were willing to go to trial.

A few weeks later, we received our trial date. It was set for 9 months later.

But the franchisor wasted no time. A few days after receiving our trial date, their lawyers reached out to my lawyer and asked if we were willing to go into arbitration. I said no. I was committed to using time as my friend. I was in no rush to negotiate with them. I had 9 months to kill.

A few days later, they offered to settle for $12,000. They wanted $1,000 per month for one year. They came off their price another 50%.

I waited a few days to reply. I asked my Attorney to counter with half the balance of my retainer account, which came out to roughly $2,200.

They countered the same day at $8,000.

My attorney begged me to take it. He said I was losing money with each counter because he was charging me $125 per email.

I told him the only money I was willing to give them was the balance of my retainer so we had to settle this with what remained.

I waited a few days and countered again.

This time with options.

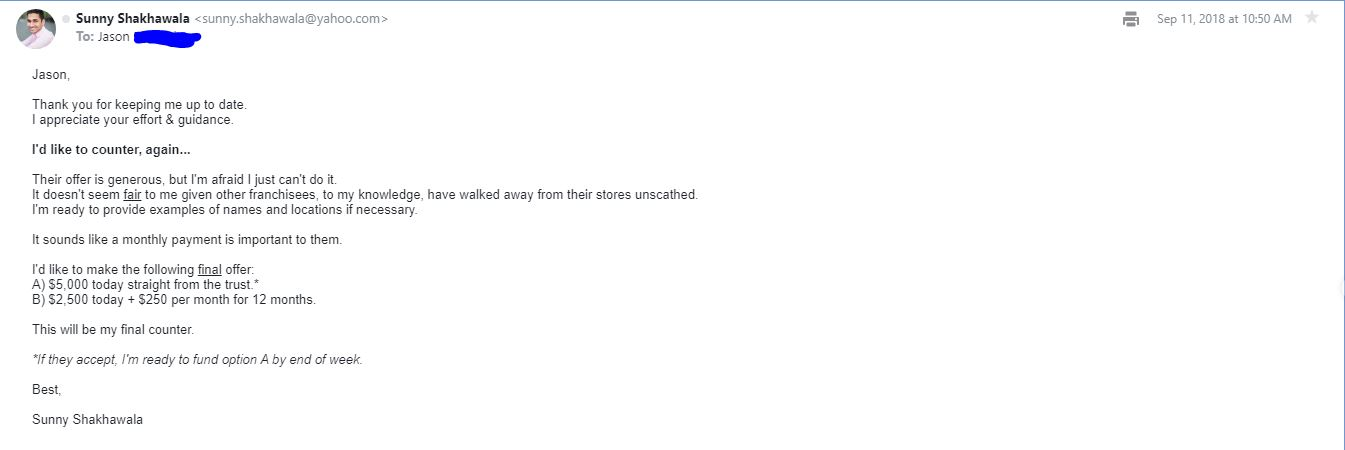

In a second, I’ll show you an image of the email I sent my attorney before my final offer was accepted.

In this email, I used four more tactics from Never Split The Difference: I used the F-word, I didn’t compromise, I guaranteed execution, and I applied the Ackerman Bargaining Method.

The F-Word

The F-Word

The most powerful word you can use while negotiating is “Fair”.

The most common use is a judo-like defensive move that destabilizes the other side.

You could say something like “We just want what’s fair.” But you have to be careful because you can’t use this word more than once, otherwise it seems like you’re complaining.

As you can see in my email, I said, “It doesn’t seem fair to me given other franchisees, to my knowledge, have walked away from their stores unscathed.

Never Compromise

Never Compromise

I wasn’t willing to compromise my position. To me, no deal is better than a bad deal. I made it clear this would be my final counter offer before waiting for trial.

Guarantee Execution

Guarantee Execution

I also guaranteed execution by saying I’m ready to fund Option A by the end of the week.

Ackerman Bargaining Method

Ackerman Bargaining Method

Finally, I applied the Ackerman Bargaining Method which states you want your opening offer to be roughly 65% of your target price. My goal was to get this lawsuit settled for what was left in the retainer account with my attorney.

That’s why I opened with $2,200. As you get closer to your target price and you’re ready to make your final offer, you throw in something trivial. It doesn’t really have value to you, but it’s a show of good faith to your counterpart.

The way I did that was I made two offers:

Option A was $5,000 payable by the end of the week.

Option B was $2,500 today and $250 per month for 12 months.

They’re basically the same amount, but the $250 per month for 12 months seemed to jive with their opening offer of $2,000 today and $1,000 per month for 12 months.

Luckily, they chose Option A.

I sent another $1,000 bucks to my attorney and called it a day.

Not to toot my own horn, but my attorney was pretty surprised they went for my offer and ended his email with “I would not want to play poker with you.”

At the end of the day, we went from $60,000 down to $6,000 including my attorney’s fees.

I owe a lot of credit to a book that cost just $20 bucks.

Thank you, Chris Voss.