In this video, my wife, Diana, will be joining us to ask 15 questions we received from you on Instagram and Twitter.

In this video, my wife, Diana, will be joining us to ask 15 questions we received from you on Instagram and Twitter.

These 15 questions span from our relationship to personal finance, health and fitness, and of course real estate investing.

In an effort to keep this video short, I’ll try to keep each answer to 30 seconds or less.

The first question is 2 questions.

How Did You and Your Wife Meet?

How Did You and Your Wife Meet?

Where did you and Dia go on your first date?

Where did you and Dia go on your first date?

Dia and I met in the summer of 2009 on a study abroad trip across Western Europe.

It was a multi-country program, so we spent 1 week in Barcelona, 1 week in Paris, 1 week in Milan, half a week in Athens and another half week on the island of Rhodes off the coast of Greece.

The program had 30 students from all across the world.

There were kids from Indonesia, Mexico, Armenia, Egypt, Holland, Argentina, Panama, the United States, and a bunch of other countries.

My roommate on the trip went to the same university as Dia so we found ourselves in the same sub-group of friends from the very beginning.

Once that program ended, we stayed in touch, did a long-distance relationship for a few years and then ultimately got married in 2015.

And for our first official date, we skipped class to grab gyros at some hole-in-the-wall restaurant in Athens.

What’s the biggest thing someone can do to improve their finances?

What’s the biggest thing someone can do to improve their finances?

I think the biggest thing someone can do to improve their finances is to pay themself first by automating their investments.

Here’s what that looks like in practice for us.

First, we max out Dia’s 401K through her work. We never even see the money.

It gets automatically deducted right out of her paycheck every 2 weeks.

Then we also max out both of our Roth IRA and family HSA plan.

On the first of every month, we send $500 to each Roth IRA and $600 to our Family HSA.

These investments get funded first, no matter what.

That way, we can spend whatever’s left guilt free.

This wasn’t always the case.

When our incomes were lower, we couldn’t afford to max out everything, but we still had our auto transfers set up.

As our income grew, we avoided lifestyle creep by investing the difference.

Once we hit the max on all the accounts, we got a little more comfortable spending on “frivolous” things.

What advice would you give to someone who wants to get into real estate?

What advice would you give to someone who wants to get into real estate?

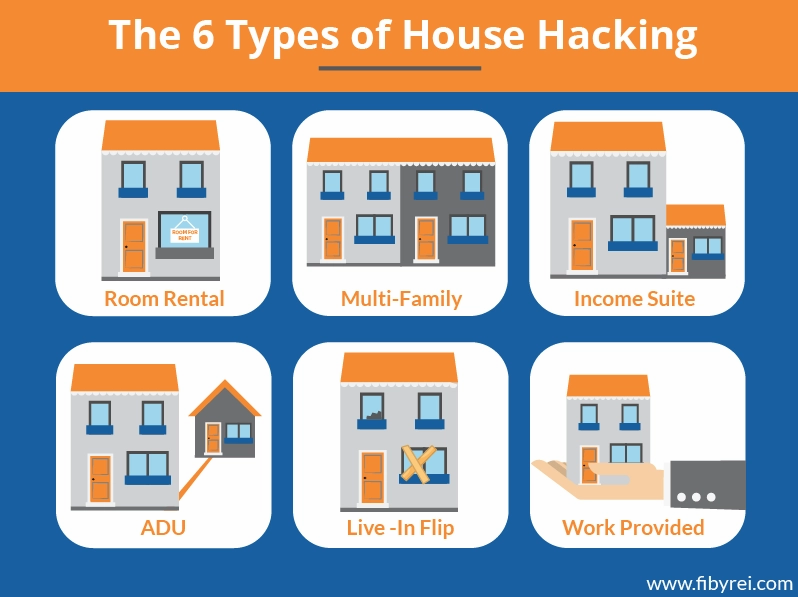

I think the simplest and safest way to start investing in real estate is by doing something called househacking.

We never did this, and I really regret it.

Househacking is when you buy a small multi-family home and live in one unit and rent out the others.

Ideally, you live for free while getting a taste of what it’s like to be a landlord.

The person you want to follow for that strategy is Matt Porcaro of @The203KWay on Instagram.

There are also two really good books on the topic:

The first is Set For Life by Scott Trench and The House Hacking Strategy by Craig Curelop.

Is Real Estate For Everyone?

Is Real Estate For Everyone?

Yes and no.

There are so many different ways to get into real estate.

You can buy a primary home, you can buy an investment property, you can become a realtor, or a mortgage broker.

You can flip a contract. You can flip a house. You can become a property manager.

I think you have to find a strategy that speaks to you and test it out.

For example, Dia and I own over $3.5M worth of investment property but we currently rent where we live.

Investing in a primary home just isn’t for us right now.

We barely have enough time to clean our home or do our laundry.

I can’t imagine mowing lawns, shoveling snow, replacing burnt out light-bulbs, fixing leaky toilets, etc.

I also don’t think most people understand the true cost of home ownership.

Renting, especially in coastal markets, can be a better financial decision than owning.

That’s not to say we’ll never own. But it’s just not for us right now.

What does your diet look like?

What does your diet look like?

Whenever we eat at home, I try to eat the same thing for every single meal because I don’t like to think about what I’m going to eat.

At 7am I drink a fruit and protein smoothie.

At 9am I eat a turkey bacon, egg and cheese burrito.

For lunch I have fruit and yogurt.

For dinner I eat whatever Dia makes.

And then I eat cereal and / or ice cream every night.

It’s really bad, but we aren’t going to talk about that.

I get my variety when we go out to eat.

My favorite takeout food is Chick-Fil-A, Mexican, or Sushi.

Except we can’t eat Sushi right now because Dia’s pregnant.

What’s your current fitness routine?

What’s your current fitness routine?

I workout every weekday at 530am.

On Mondays and Tuesdays, I do regular weight lifting type stuff. Bench, Deadlift, Squat, Curls, Tricep Extensions, etc.

On Wednesdays and Fridays I go to CrossFit.

I fast til 5PM on Thursdays so I typically just sit on the rower or elliptical for 20-30 minutes.

That’s enough to wake me up, but not enough to make me crazy hungry.

Does investing in property make it harder for first-time home buyers?

Does investing in property make it harder for first-time home buyers?

It definitely did in our case.

We own a bunch of rental properties and although we both make a decent income, our tax returns look really bad.

Most retail lenders aren’t willing to look past our tax returns, so it’s difficult for us to get financing in our personal names.

With that said, I think if you have a strong W-2 income and you’re NOT a real estate professional, you should be in a better position that us because there’s a limit to the passive losses you can take.

Do you think we’ll see a change in the housing market in the next few years?

Do you think we’ll see a change in the housing market in the next few years?

I have no idea what’s going to happen, but if I had to guess, I think home prices are going to continue to rise.

The increase will be higher at lower prices and lower at higher prices.

I expect sub 500K homes to increase the most.

500K-1M homes will increase, but not as much.

Anything over 1M may or may not increase at all.

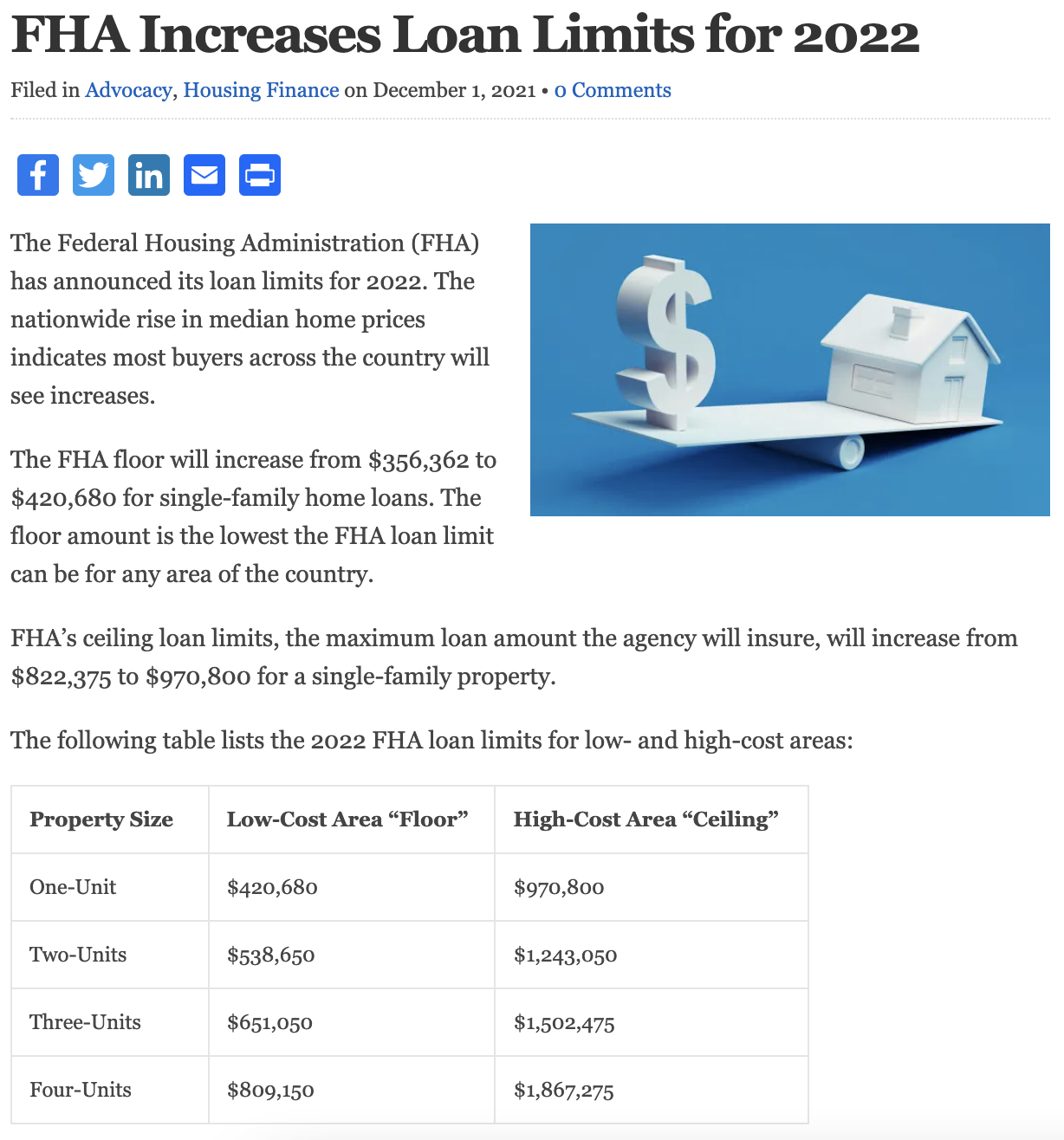

One data point I can share that supports this is the FHA increased their loan limits by 18% in 2022.

Thats the record for highest increase per year.

What Book Are You Currently Reading and What Podcast Are You Currently Listening To?

What Book Are You Currently Reading and What Podcast Are You Currently Listening To?

Since we’re getting close to the end of the 2021, I’m rereading 3 classics: Awareness by Anthony De Mello, Siddhartha by Herman Hesse, and Man’s Search For Meaning by Viktor Frankl.

I also recently flipped through Show Your Work by Austin Kleon because I needed some inspiration for the YouTube Channel.

My favorite podcasts right now are My First Million with Sam Parr and Shaan Puri and The Tim Ferriss Show.

When Dia and I are together, we like to listen to Business Wars and I Will Teach You To Be Rich by Ramit Sethi. That podcast is awesome because he helps couples work through their money problems. We’ve only listened to a few episodes, but it’s interesting to hear about people’s relationship with money, especially when it’s effecting the relationship with their spouse.

Describe your dream vacation

Describe your dream vacation

Now that I’m a dad, I think my dream vacation would be Disneyworld or Disneyland. Or maybe a Disney cruise.

I’ve never been to Disney and Luna loves Mickey and Mini so seeing her go nuts would probably be a good time for me too.

I would like to go to the Harry Potter-world and drink some butterbeer.

Who is your favorite mortgage broker of all time?

Who is your favorite mortgage broker of all time?

My cousin, Mehul asked this question and the answer is obviously…. my cousin, Mehul.

His email is mehul@bluerockmortgage.com.

If you need to purchase or refinance a property in an LLC, he has the best loan product by far.

Did you achieve your real estate goals for 2021?

Did you achieve your real estate goals for 2021?

No. My goal for 2021 was to acquire enough property to generate $1M per year in rental income. I didn’t even come close. I think we’re at like $200K per year in rental income.

However, I feel like I succeeded despite my failure.

I spent the year building out a process to market directly to distressed home owners.

Now that I have those systems in place, it’s only a matter of time before I reach my goal.

In 2022, I’m investing HEAVILY into making that process even better so I can’t wait to see where we land.

What is your favorite pizza topping

What is your favorite pizza topping

Buffalo Chicken.

In terms of personal finance, how important is it to donate to charity?

In terms of personal finance, how important is it to donate to charity?

I’m a firm believer that you have to give first in order to receive.

But I’ll also say we only started consistently donating to charity within the past 5 years and we started for selfish reasons.

We support their organization to the best of our ability because it’s about all we can do in the effort to keep her alive for another year.

I used to think “I’ll donate later, when I’m old and rich”. I’m glad I got over that hurdle, because I’m certain my desire to be charitable motivates me to earn more. It’s a virtuous cycle.

My suggestion would be to start small. Donate 1% of your income to a cause that really means something to you. If you don’t notice the money missing, move up to 2% of your income the following year. That value will come back around in one way or another.