I'm so frkn lucky.

I've had to stop, breathe, and remind myself of that so many times recently. Mainly because we have so many life-changing events happening at once.

And instead of seeing these imminent changes as opportunities, I default to seeing them as problems I need to figure out.

But these situations I'm framing as "problems to solve" can just as easily be seen as "opportunities to explore".

What's the difference?

Basically everything: the entire experience changes if you can make this mindset shift.

Problems that need solving rob you of a good night's sleep and add undue stress. Opportunities to explore are energizing and fill your cup with joy.

IDK what I'm sayin'. Just putting a random thought out there in the hopes that it helps someone who might need the same reminder.

Livin La Vida Luna

Here's Luna (& co.) showing support for her cousin Ariya on Rare Disease Day.

I recently decided to sell two of my investment properties.

The first is a Duplex in Westfield, NJ. We’ll call it Livingston.

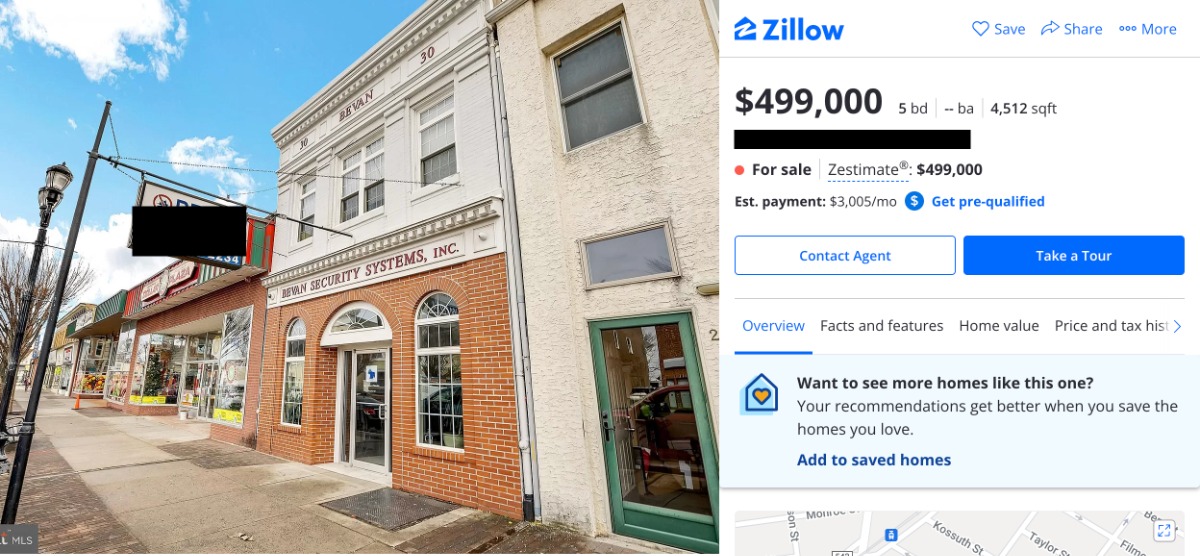

The second is a 4-Unit Mixed-Use Building in Riverside, NJ. We’ll call it Scott.

Livingston is geared more towards an owner-occupant. I expect the buyer to be someone who will live in one unit while renting out the other in an attempt to reduce their monthly cost of living.

Scott is geared more towards an investor. I expect the buyer to be someone looking to park their money and generate decent returns over the next decade or so.

We listed both of these properties towards the end of February 2022, and they yielded different results. I believe this is mainly because we went in with different pricing strategies.

Pricing Approach

When you price a home for sale, there are 3 strategies you can take.

- Discount to Market Approach: List low and hopefully drive the price up with competing bids.

- Swing For The Fences Approach: List high and hope the right buyer is willing to meet you at your price.

- Just Right Approach: List it right at what the market can support. You likely won’t be overwhelmed with offers, nor will you be hung out to dry.

For Livingston, we took the “Just Right” approach. We looked at the comps and decided to list the property at $549K.

After our open house weekend, my agent said everyone thought the house was priced exactly where it should be.

For Scott, we took the discount to market approach. Based on our Net Operating Income, I believed this property could appraise for $550-$600K. We decided to list at $499K.

Exposure

At Livingston, we did two days of Open Houses for two hours each. In one weekend, we probably had 40-50 interested parties walk through the property.

For Scott, we had to take a different marketing approach. We couldn’t do open houses because all the units are currently occupied by tenants so showings were by appointment only. It’s safe to say we didn’t get nearly as many eyes on Scott as we did on Livingston. I think less than 12 interested parties saw the property.

But because of the difference in pricing strategy, the offers we received were wildly different.

Offers

For Livingston, we received only 1 offer during the first week. It came in right at our asking price: $550K with 20% down conventional loan & 20-day closing of 4/20/22.

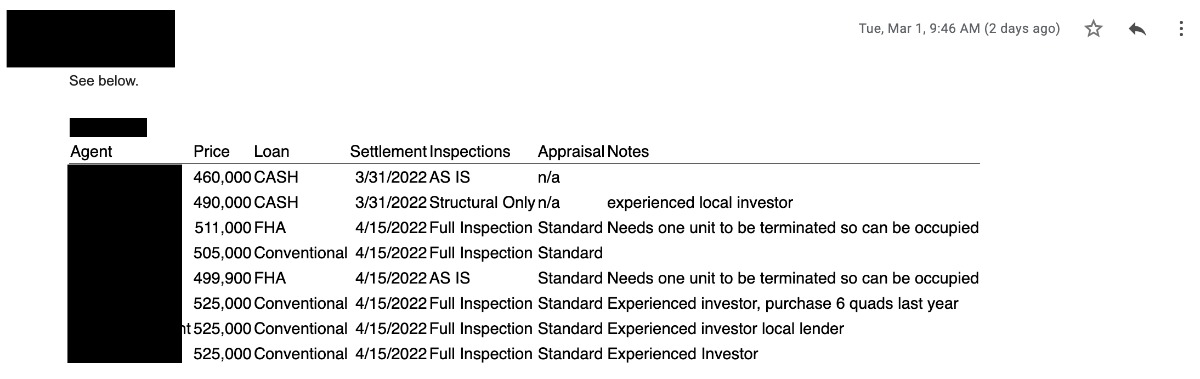

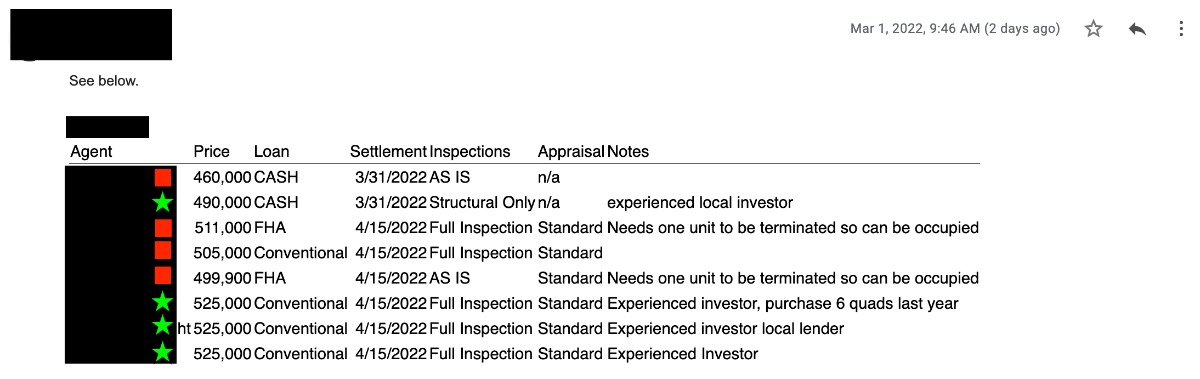

For Scott, we received 8 offers in the same time period. Most of them were above our asking price.

Understanding Leverage in a Negotiation

For Livingston, we didn’t have much leverage outside the fact that we were on the market for less than a week.

For Scott, we had plenty of leverage. Multiple people wanted this deal and many of them were in the same price range.

Our first step was to disqualify as many offers as we could. We immediately axed the FHA buyers because their lenders are typically difficult to work with. Then we cut the low-ball cash offer of $460K. Finally, we cut the slightly above ask offer with conventional financing because we had three other conventional financing offers for $20K more.

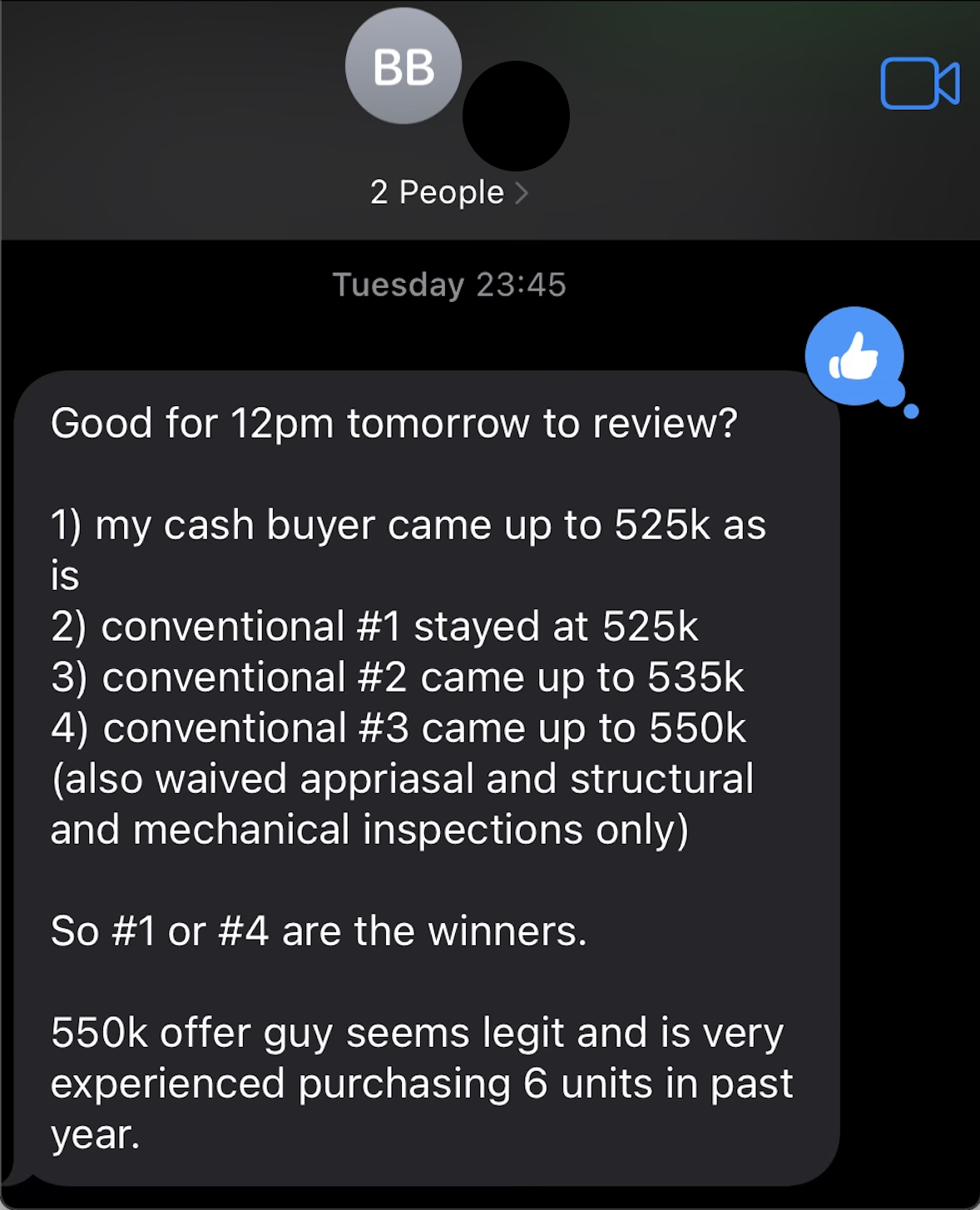

We were able to cut the field in half before reaching back out to the remaining four buyers. We DID NOT counter with a price. This is very important. We didn’t say a number and hope someone would meet it. Instead, we did something I don’t think people do enough of: we let them negotiate against themselves.

Secondly, we implemented an artificial deadline. Our agent called each buyer before noon on Tuesday, March 1st, and set a cut off for 8pm later that same day.

Our agent told each of these four buyers that we were in a best and final situation and there were 4 competing bids that were almost identical to each other in terms of price and inspections.

Here were the results:

3 of the 4 buyers increased their price.

One went up by $35K and another went up by $25K.

We ultimately sent a contract to the $550K offer and are looking forward to a smooth closing with him.

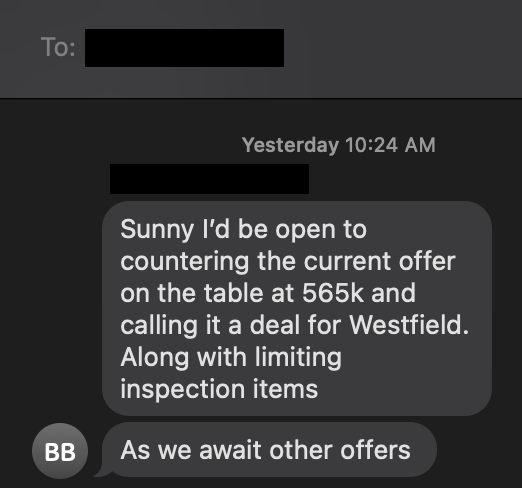

The offer situation at Livingston was much less fun.

As I said before, we only received one offer and it came in right at our asking price of $550K.

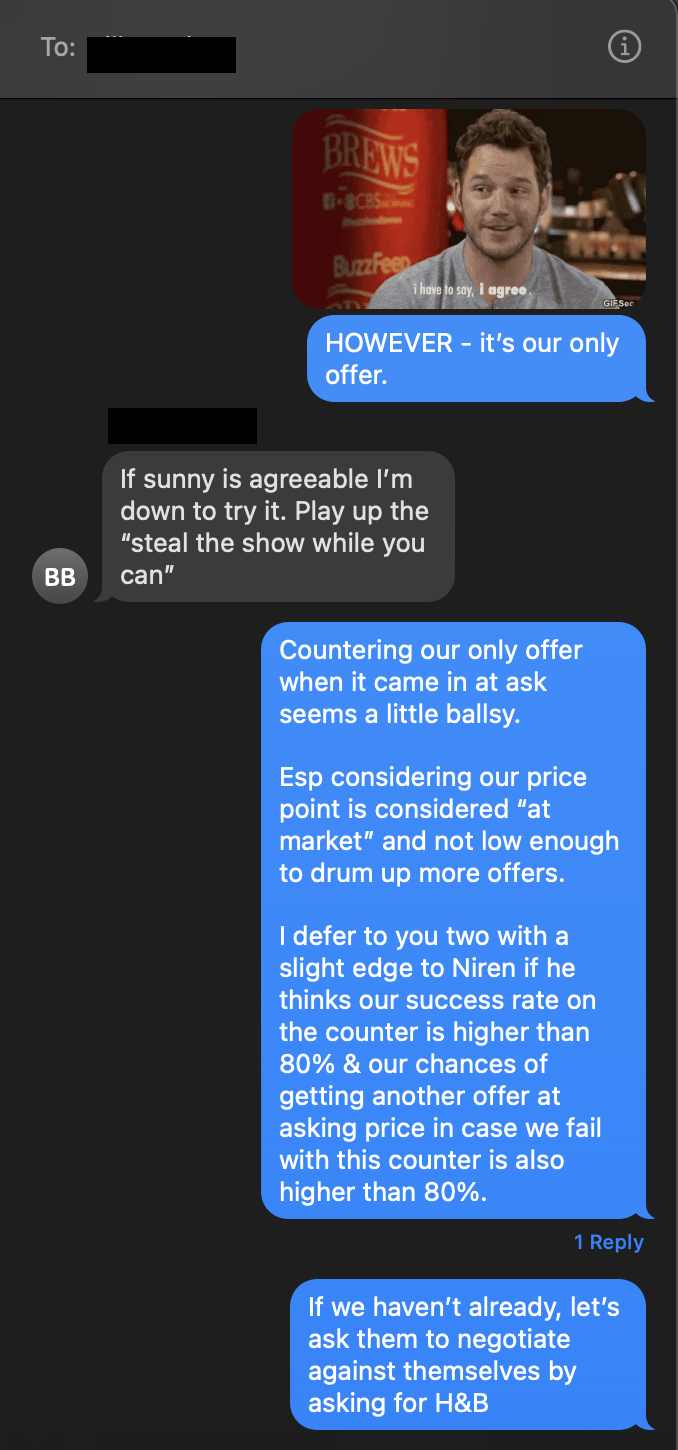

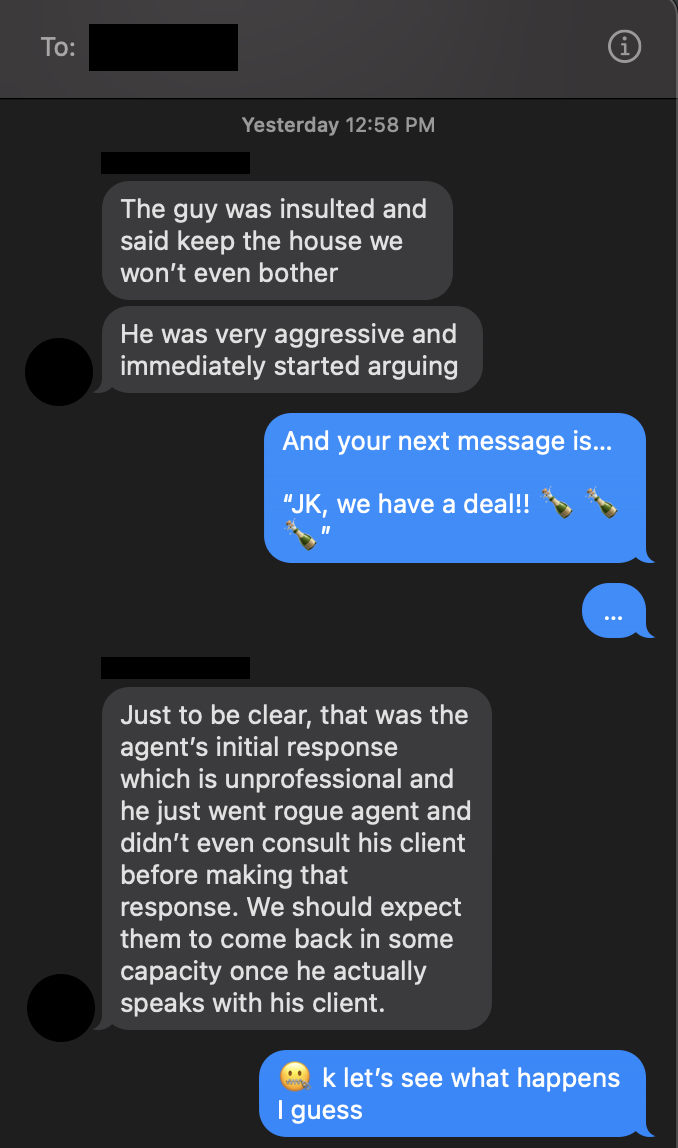

This is where things sort of got messy.

My partner wanted to counter the offer at $565K AND get the buyer to drop some of their inspection contingencies.

I was hesitant about that idea.

I was happy we got what we asked for and one thing I learned from watching every single episode of Shark Tank is when you get what you asked for just shut up and say yes. Don’t insult Robert by waiting for Mark to come in and steal the deal with his stupid 24-second shot clock.

I should have stuck to my guns. Ultimately I let greed get the best of me and agreed with the approach. We asked the buyer's agent to increase their bid by $15K and waive their inspection contingency.

Their agent was NOT happy. Apparently, he took our aggressive ask very personally.

I think I really dropped the ball here. I’m the lead investor in this deal and although I appreciate and heed the guidance of my partners, the buck stops with me. Obviously, another $15K would be nice, but we lost sight of the fact that we already had enough to be grateful for. The offer came in at our asking price.

This was a tough lesson learned in understanding leverage when it comes to negotiating. I’m probably worrying over nothing and we will ultimately sell this property just fine, maybe even for more. But I don’t want to result myself into thinking countering the above ask offer was a good decision. We should have said yes and called it a day.