Weekly Recap:

- We signed a new lease - we're moving tomorrow (HMU for new address).

- Dia's brother and nephew booked a flight to come help with the move - they arrive tonight. 🛩

- I signed up for a new mastermind to refine my direct-to-seller marketing system. ✉️

- We went under contract to sell another property. 😅

Best,

Sun ☀️

Livin La Vida Luna

Which is bigger? Luna's ears or Minnie's bow?

I'm Paying $15,000 For a Signature ✍🏽

In June 2021, we bought an off-market Duplex in Madison, NJ for $485,000.

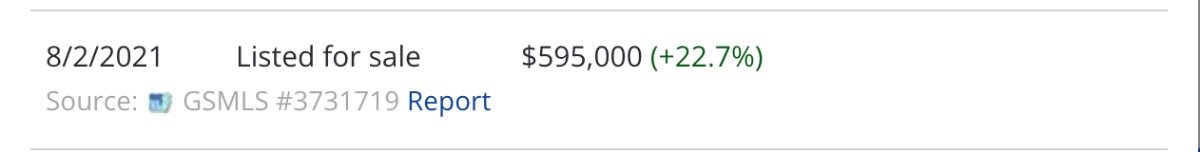

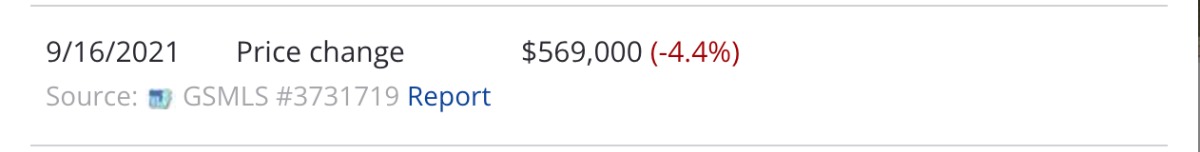

In August 2021, we listed it for $595,000 without making any improvements. (PROTIP: Never list a property in August - straight crickets 🦗).

In late August / early September, we went under contract at $575,000, but that buyer ultimately backed out.

So we re-listed the property and reduced the price to $569,000.

On October 20th, 2021, we signed a contract for sale for $565,000 with our current buyer.

It’s Not That Easement

Today is March 13, 2022, and we have yet to complete this transaction because of an easement issue.

An easement gives someone a right to cross or otherwise use someone else's land for a specified purpose.

Unfortunately, our property shares a driveway with a neighbor. However, we both have our own parking behind our respective homes.

Here’s the google map image:

This has been the case since these properties were built and put in service, but for some reason, no one ever checked the actual property lines...until now.

According to the property lines in the Title Survey, the driveway mostly “belongs” to the neighbor.

Our buyer’s lender requires an easement to be recorded upon sale. This is annoying, but not impossible.

We asked a survey company to draw up new plans. We had them in hand by the end of November 2021.

Since this easement impacts the neighboring property, we needed to track down the owner and get them to sign a document giving us their approval to record this change with the township.

Finding the neighbor’s name and phone number was easy enough through the skip tracing services we use on a regular basis.

When we told him the situation, he laughed and asked, “Why is this such a big deal? We’ve been sharing this driveway forever.”

He bought his property in 2006 and our property had traded hands thrice in that same amount of time. This had never been an issue until now.

Anyway, the neighbor provided his lawyer’s contact information and assured us we’d get this squared away.

We had our lawyer reach out to the neighbor’s lawyer and that’s when they dropped the hammer.

They wanted $30,000 (!!!) in exchange for their signature.

I was floored. My initial reaction was to kill the contract, refinance the property into long-term fixed-rate debt, and add this property to our rental portfolio purely out of spite.

There was only one problem: This property appraised for $565,000, and we would only be able to recover 75% of that through a new loan.

75% of $565K is $425K. That $425K would be about $75K short of how much we had spent to acquire and service that property for the past 6 months.

- Purchase Price: $485K

- Carrying Costs for 6 months: $15K

- All-in: $500K(+)

We were between a rock and a hard place. We could keep the property to spite the neighbor, but I’d have to leave $75K in a mediocre deal. Or we could bite the bullet, let the neighbor take almost all of our profits, and exit this fiasco.

Over the following week, we ran both scenarios in parallel.

It turned out, even if we were able to get a favorable appraisal for a refinance and pull out most of our money, the rental income from this property in its as-is condition would barely cover the PITI (principal, interest, taxes, and insurance).

We’d also have to invest roughly $40 - $50K to improve the property to attain top-of-the-market rents. These two hurdles made selling the property option #1.

Thankfully, we were able to negotiate the neighbor down to $15,000.

Then it became a waiting game. We had to get approval from the neighbor’s lender as well. It took 3 long months for the approval to come in.

I think we’ll be closing this week, but I honestly can’t be sure. This property has been stumbling its way to the finish line ever since we bought it. Who knows what else might pop up between now and the closing table.

All I know is we’re about to get smoked on this deal. What was supposed to be a 90-day wholetail turned into a 10 month-long headache.

Post-Mortem

If we could go back and do things differently, here’s what we‘d do.

1) We’d get a Title Survey before purchasing. I’ve never done one before, but now I’ll never not do one again. It costs ~$1,000, but the potential savings are in the tens of thousands of dollars.

2) We would add value immediately. We bought this duplex with one unit vacant. We should have renovated that unit before listing the property for sale. New kitchen, 2 new baths, new floors, and a fresh coat of paint. It would have cost $30K, but I think it would have made a meaningful difference in our sales price and overall marketability.

This property is in a wealthier town of Northeast NJ so the typical buyer is going to want something turnkey. As investors, we need to do the hard work of pressing the “easy” button for our tenants or end buyers. We can’t just shift that responsibility to them and expect to get compensated well for it. It was a lazy approach and we paid the price.

3) A tangent of the point above, we need to do everything we can to create a better likelihood of outcomes for us. Basically, we need multiple exit strategies.

Once we went under contract, we were fixated on simply selling the property because so much time had passed. If we were sitting on a renovated property, we might have killed the contract of sale, rented out the vacant unit, added the property to our rental portfolio, and called it a day. But that option seemed so far away at the time. If we had known it would take an additional 3 months for the neighbor’s lender to approve the easement, maybe we would have taken that route.

4) Get used to it. Things aren’t always going to go our way. There are going to be peaks and valleys. Despite the red hot market right now, there are still ways to lose time and money in this game if we’re not careful. We’re accepting it as a cost of doing business.

If we manage to get to the closing table this week, next week’s post will likely be a recap of the numbers on this deal. I calculated our potential gain/loss back in December, but I’ve been too scared to recalculate it since then. Although we had a small cushion, I’m sure it has completely evaporated since then.

We shall see.