Had a bunch of great conversations this week.

- On Tuesday, I met up with a local real estate investor IRL. We previously only communicated through DM on IG.

- On Wednesday, I caught up with an old friend from college who moved down to Miami and is looking for his first fix and flip project.

- On Thursday, I had breakfast with a friend and we discussed potentially buying 3 new construction projects together.

- On Saturday, I spoke (at length) with a friend of a friend cardiologist who has taken a special interest in the impact of high cholesterol on people of South Asian descent.

Feeling incredibly grateful to have access to brilliant people doing big things.

☀️

Livin' La Vida Luna y Luca

We went to Benihana for Luca's first dinner in a restaurant.

He enjoyed his bottle, puffs & yogurt chips from the comfort of his stroller.

Luna cried during the flaming onion.

It was great.

Interest in Rates 🚀

I've spent the past week obsessing over interest rates.

There's a lot of financing activity going on these days:

- Potentially Keeping Fix & Flip as a Rental

- Primary Purchase

- New Fix & Flip Purchase

Keeping Fix & Flip as a Rental

We are finishing up the renovations on our 1532 Catharine St deal in Philly.

The current plan is to simultaneously list it for:

- Sale @ $800,000

- Rent @ $5,250/mo

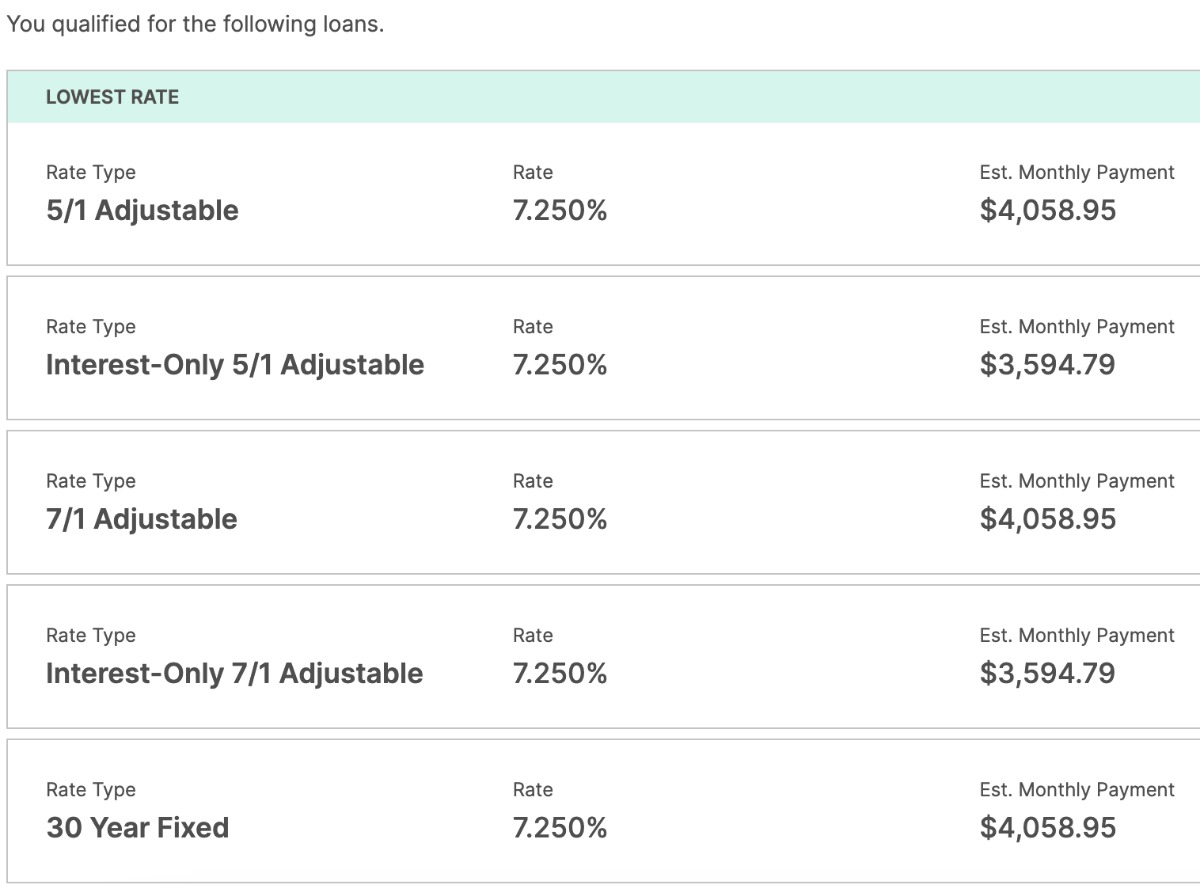

The best refinance rate I've been able to find from a DSCR (debt service coverage ratio) lender is 7.25%.

The 7-year interest-only adjustable rate mortgage is probably our best bet simply because it's the lowest payment amount for the longest time.

The monthly P&L would look like this:

+ $5,250: Rent

(-) $3,594.79: Interest Payment

(-) $583.33: Property Taxes

(-) $150.00: Insurance

= $921.88: Cashflow before Vacancy, Maintenance, & CapEx

There are two reasons we are considering holding this property.

1) It's a trophy asset in an excellent location. The current value, however, is largely impacted by current interest rates. This property would have sold for ~$1M last year.

2) The Unlevered Yield on Cost (UYOC) is decent.

+ $63,000 - Annual Rent

(-) $6,300 - Vacancy & Maint. (10%)

(-) $7,000 - Annual Property Tax

(-) $1,800 - Annual Insurance

=. $47,900 - NOI per year

At the end of the day, we'll be all into this property for $625,000.

- $500,000 - Purchase

- $85,000 - Rehab

- $40,000 - Holding Costs

That gives us a UYOC of ($47,900 / $625K) 7.7%, which is 40 basis points above our interest rate. Not great, but not bad if we can hang on long enough for mortgage rates to drop and the price to shoot back up.

Primary Purchase

We're (still) applying for a loan on a primary home and the bank we're working with is offering an interest-only mortgage at 4.4%.

That's much better than what Google says conventional lenders are offering on a 30-year fixed right now.

As each day goes by, I become less and less confident in our ability to get approved for a primary home loan.

I'm keeping my expectations at bay so if we're denied I'm not too surprised.

Fix & Flip Purchase

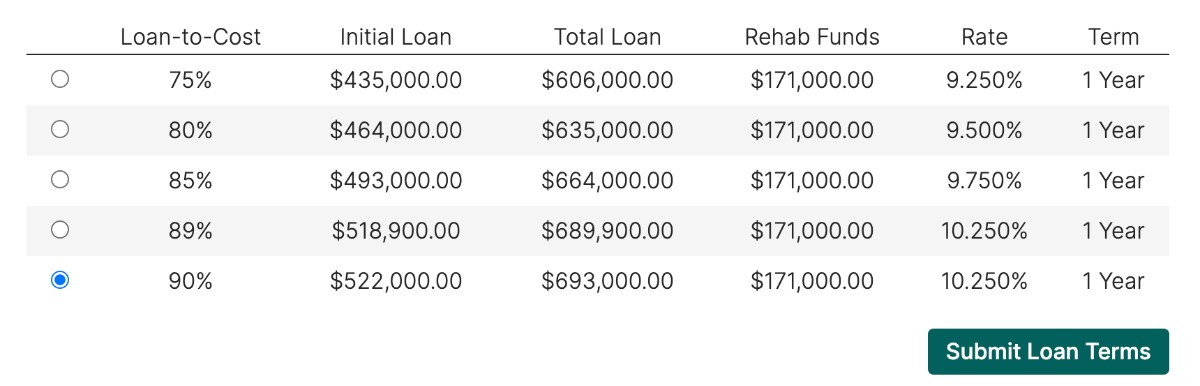

We just finalized the closing date (3/7/23) for our next flip in Philly (Front St Duplex to Condo Conversion).

We've had this property under contract since December so I had to tap our lenders to make sure the terms of our loans haven't changed.

Thankfully, they haven't.

The Hard Money Lender is on board to fund 90% of the purchase and 100% of the rehab at 10.25%

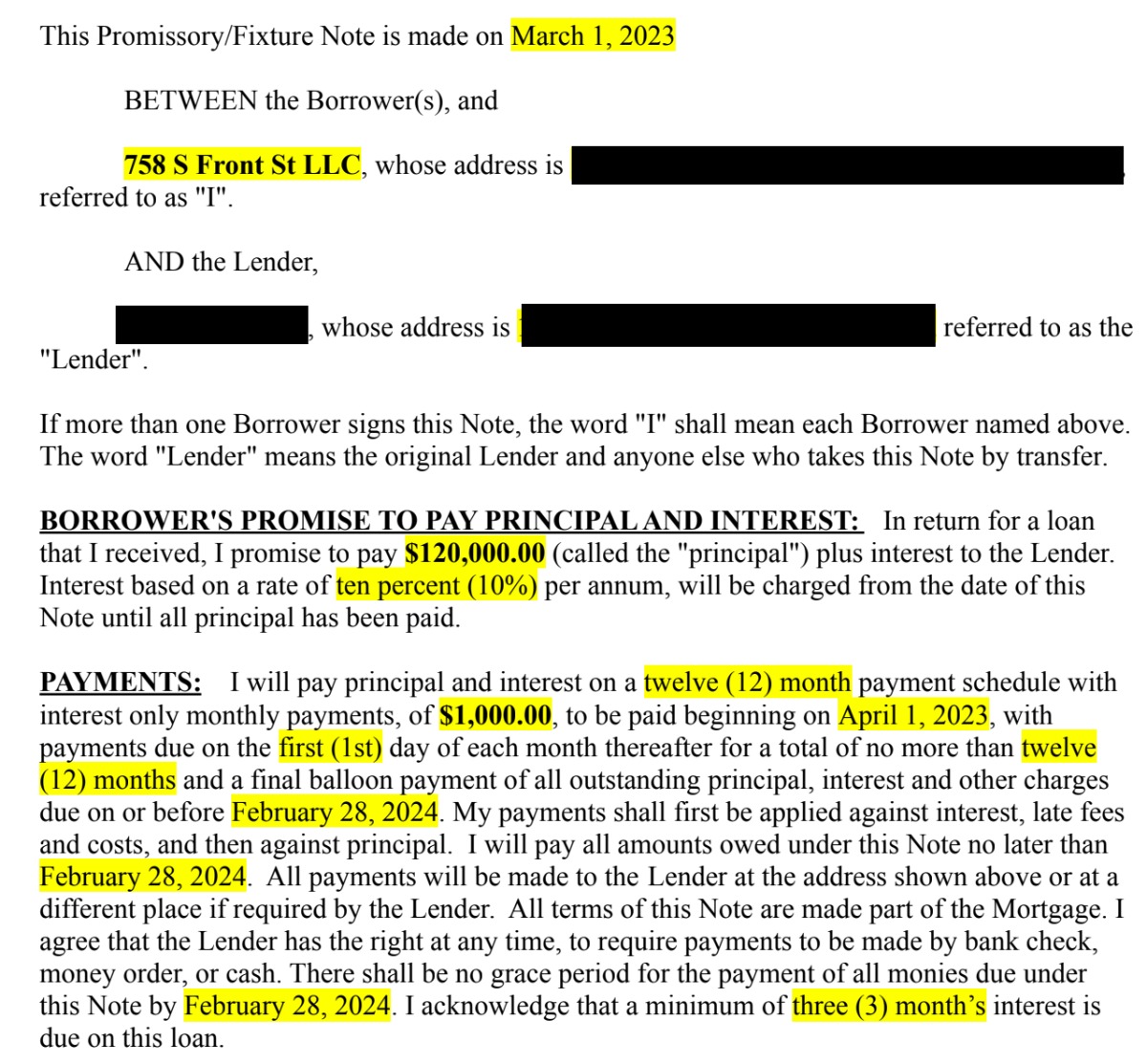

Our Private Money Lender is ready to fund the down payment ($60,000) and working capital ($60,000) at 10%, which comes out to a nice round $1,000 per month (if you're reading this - Thanks again 🙏🏽).

Video of the Week:

Upon popular request (by one person), I'm adding a new section to the newsletter.

For the foreseeable future, we'll close every issue with a "Video of the Week"

We'll kick this new segment off with my most popular video yet (with 13K views on IG).

The hook: "You're NOT going to become rich off your rental properties..."

Enjoy :)