G'morning to everyone except the CEO of Silicon Valley Bank.

When you're the head of a top 20 commercial bank, you might want to refrain from saying things like, "stay calm, don't panic" when people ask you about losing $10Bn in market cap.

It's like telling your wife to relax when you almost let the baby roll off the diaper changing station.

Asking for an extinction-level event.

C'mon Man - Shiiiiit!

☀️

Livin' La Vida Luna y Luca

All Pink x All Gray

The Monochromatic Duo.

"I think I'm getting really close to the top end of my capacity".

I shared my concern with Dia during dinner on Tuesday night. She put her utensils down and came to hug me. I really needed that.

Earlier that same day, I had just closed on another flip and took on an additional $750,000 of personally guaranteed debt.

The responsibility was weighing on me.

Mainly because ~$200K of funding came from first-time Private Money Lending relationships. I want nothing more than to exceed their expectations.

That same night, I woke up around 2 am and threw up violently.

I'm sorry. I know that sounds disgusting, but it was actually amazing.

It was the equivalent of turning the steam release handle on the top of the Instant Pot from “sealed” to “open”.

Immediate relief from all the pent-up pressure.

Exacerbating the Issue

Another thing that's been on my mind recently is the hard money loan on my new construction project is coming due on 4/1/23.

The original loan was due on 1/1/23. The lender offered me a 3-month extension, but they charged me an arm and a leg for it.

- $3,750 - 1/2 point extension fee (on total loan amount)

- $750 - New Appraisal fee

- $250 - Application fee for extension

That bought me until 4/1/23. If I want to extend again, I have to pay all the same fees, which doesn't sit right with me.

Especially since I would have to extend again anyway. 3 more months don't quite cover the remaining timeline for the project. We're expecting to be done closer to the end of summer.

So I decided to pay them off with a mix of my own cash and private money.

That fundraise isn't inconsequential. I need to come up with roughly $500,000 to pay them off.

Diagnosis

After carefully reflecting on the issue, I came to the conclusion that I have too much debt.

Rentals:

- Champion: $430K on $600K valuation (70% LTV)

- Walnut: $250K on $320K (80%)

- Total: $680K on $920K (74%)

Flips:

- Washington: $1.25M on $1.7M valuation (60% LTV)

- Catharine: $675K on $800K (85%)

- Front: $750K on $1.05M (70%)

- Total: $2.425M on $3.550M (68%)

Blended: $3.105M on $4.470M (70% LTV)

When you look at it as a whole, it doesn't seem that bad. 30% equity is enough margin to make it out of pretty much any downturn.

Next Steps:

I'm not someone who spends more than a few minutes worrying about something without taking action.

Especially if it's robbing me of my sleep.

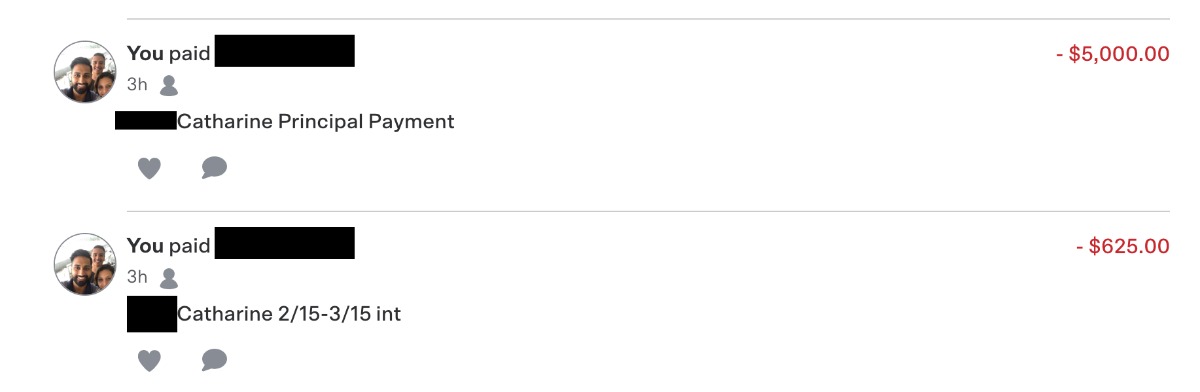

The first move was to distribute some excess funds from our Catharine St project.

One of my lenders funded us with $75K and I plan to pay them back $15K by the 15th of March.

The monthly payment will go from $625 to $500, but more importantly, I'm wiping away 20% of the debt owed to this one person.

My second move was even more drastic. #NoSmallBoyStuff

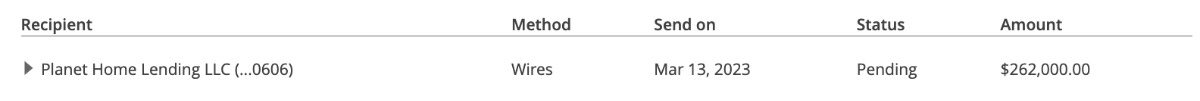

I paid off 50% of my hard money loan on my new construction project ($262K).

Some might say I'm cutting off my nose to spite my face, but I don't care.

I'm allergic to paying unnecessary fees especially when they make for band-aids on a gunshot wound. I'd rather take back control from my lender and finish the project as stress-free as possible.

I've been sleeping like a baby ever since.

Video of the Week

Hook: When I quit my 9-5 office job in 2014, I was making ~$75,000 per year. It took me 8(!) years, until 2022, to exceed that income as a self-employed person. If I could go back and do it all over again, here's what I'd do differently:

Why I think it worked:

- Attention: Quitting office job - everyone (thinks they) want to do that

- Doubt: Took forever to get back to the same income

- Reflection: What I'd do differently...

You kind of have to watch the rest of the video if you make it that far.