We went to Philly this past week for a long weekend staycation.

We settled into the Windsor Suites (1 Bedroom Suite is great w/ 2 kids) Saturday afternoon.

We hit the Franklin Institute on Sunday, the Philadelphia Zoo on Monday, and the Camden Aquarium on Tuesday before heading home.

It was a packed schedule, but I managed to sneak in a 30-minute coffee with my business partner, Francis Mangubat, while the kids napped.

That was all the time we needed to submit an offer on another fix-and-flip opportunity.

☀️

Livin' La Vida Luna y Luca

My business partner and I recently met up for coffee to discuss a new opportunity.

I pulled out my phone and started crunching numbers in my Google Sheets app.

He was impressed I could confidently calculate an offer from my phone.

I told him this is my process every single time a fix and flip crosses my desk. I just need to get confident on a handful of numbers before I'm ready to send an offer.

The rest of this post outlines what those numbers are.

The property in question was 728 S Warnock. It was listed for $351,000. A *very* competitive price - we knew off the bat we'd be coming in above ask.

Step 1: ARV

The first step in my process is to determine a conservative ARV - or After Repair Value.

Based on a few comps, we pegged the ARV at $850K.

Once Francis got back to his desk, he found evidence that the ARV could actually be closer to $920K, but we did NOT adjust our analysis to reflect that (this was a mistake - more on that later).

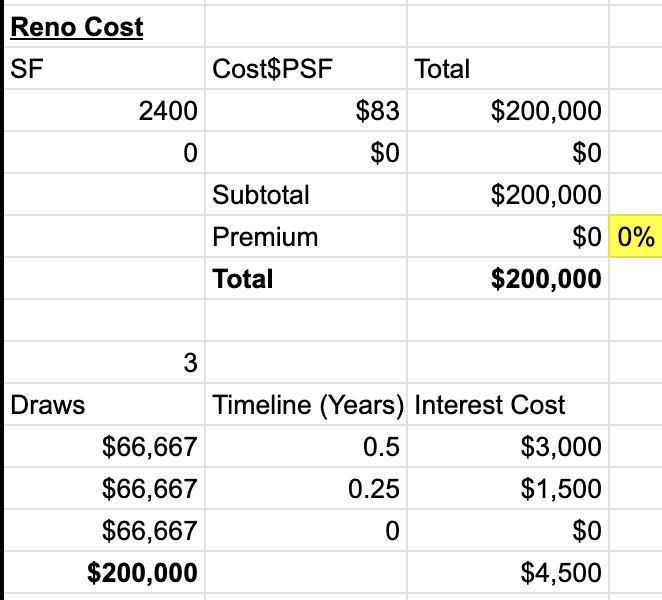

Step 2: Reno Costs

The second line item I need to determine is the "how much will it take to get us there?" number - AKA the Reno Costs.

Based on the flip we just completed (1532 Catharine), we assumed it would take $200K to get this property to the finish line.

We spent $100K (hard costs) on Catharine.

Warnock required a new set of Mechanicals as well as some framing and drywall.

We thought an additional $100K would cover it. That *might* have been too conservative.

Step 3: Cost of Capital

The last item to account for is the Cost of Capital.

We have access to various forms of financing, but the worst terms we are getting right now are 3 points and 9% interest.

We look to finance 100% of the purchase price, renovation costs, and 1.5x the first construction draw.

Most of the time, we receive 85% of the purchase price and 100% of the construction budget from a Hard Money Lender like Kiavi.

Then we look to a private money lender for 15% of the purchase price (down payment) and 1.5x the first construction draw.

In this scenario, we assumed a reno budget of $200K. If we take 3 draws, that comes out to $200K / 3 * 1.5 = $100,000 in "working capital".

Step 4: Net Profit + Purchase Price

I know I said Cost of Capital is the last item to account for, but there is technically one more: minimum net profit.

The net profit requirement + everything else we've calculated in Steps 1-3 ultimately determines what we're allowed to pay for the property.

Francis and I decided we needed to make $50K each for this deal to be worth it.

So we underwrote to a $115K net profit (15% contingency) to determine a purchase price of $411K.

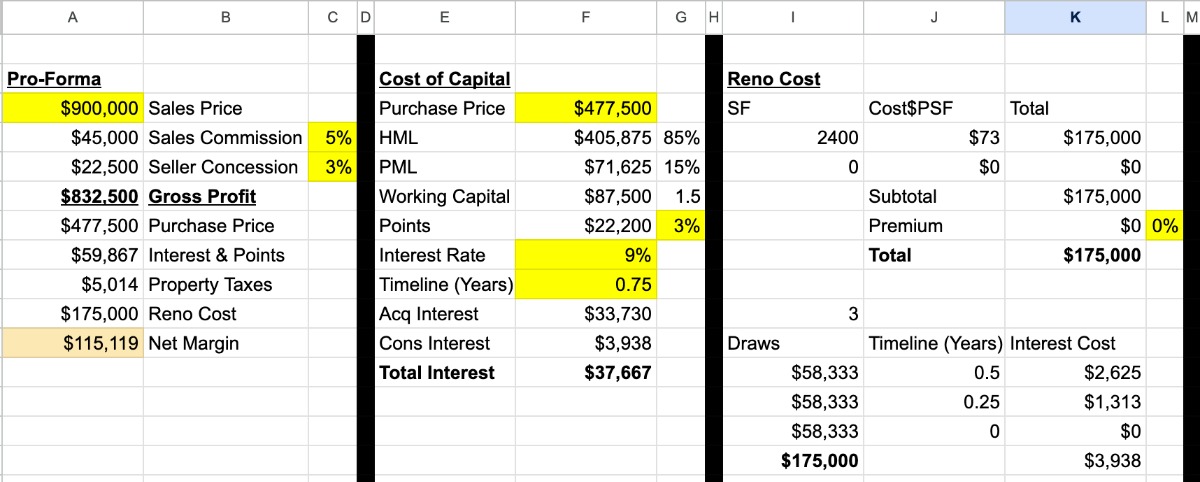

Here's the big picture:

Tip 1: Speed to Lead

Since the beginning of 2023 - we've bought $1M+ worth of property in Philadelphia directly off the MLS and we've made another $1M+ in offers that weren't accepted.

Our success boils down to one thing: Speed to Lead.

Francis scours the MLS most mornings for new listings in premier neighborhoods. If something interesting pops up we hop on a call to underwrite it together in less than 20 minutes.

Once that's complete - we're sending offers almost immediately. I have to imagine we're the first offer for every deal we bid on.

We Got Beat

Unfortunately, we did NOT win this deal.

I think we underwrote it too conservatively.

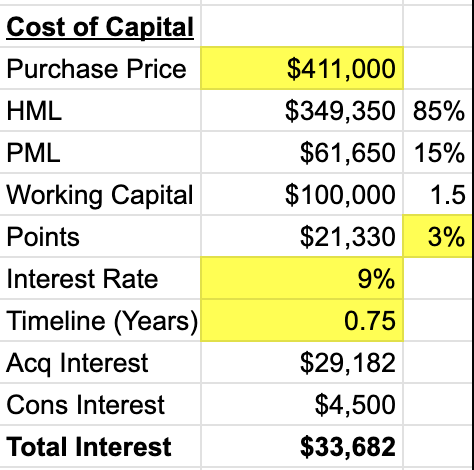

If I could go back and analyze this property again, I'd change 2 things.

1) The ARV. I would change it from $850K to $900K.

2) The Reno Costs. I would change it from $200K to $175K.

Those two adjustments would have allowed us to increase our purchase price to $477,500 - a full $66,500 above what we initially offered AND $125,000 above the asking price.

Tip 2: Escalating Offer

In these scenarios, when you know you have to come in way above the asking price to have a shot at the deal, it's prudent to put in an Escalating Offer.

So our offer wasn't technically $411,000.

It was actually "Beat all other No Contingency + Cash Offers by $2,500 up to $411,000".

An escalating offer is a great way to win, but not pay much more than the next guy (or gal).

--

🤞🏽 I really hope the winning bid was greater than $477,500.

Regardless, these opportunities are like buses. There's always another one coming.