G'morning to everyone except the people who pulled their cash deposits out of First Republic Bank.

They were the *only* lender willing to give me a primary home loan and now they're getting taken over by the FDIC.

☀️

Livin' La Vida Luna y Luca

FIRE-Preneuer

In the past 10 days, I've talked to two different people who fit the same bill:

- Tail-end of high paying white-collar career

- Young (in age and spirit)

- Plenty of savings and investments to retire comfortably

- Interested in trying their hand at entrepreneurship

The first conversation spanned >2 hours (in person).

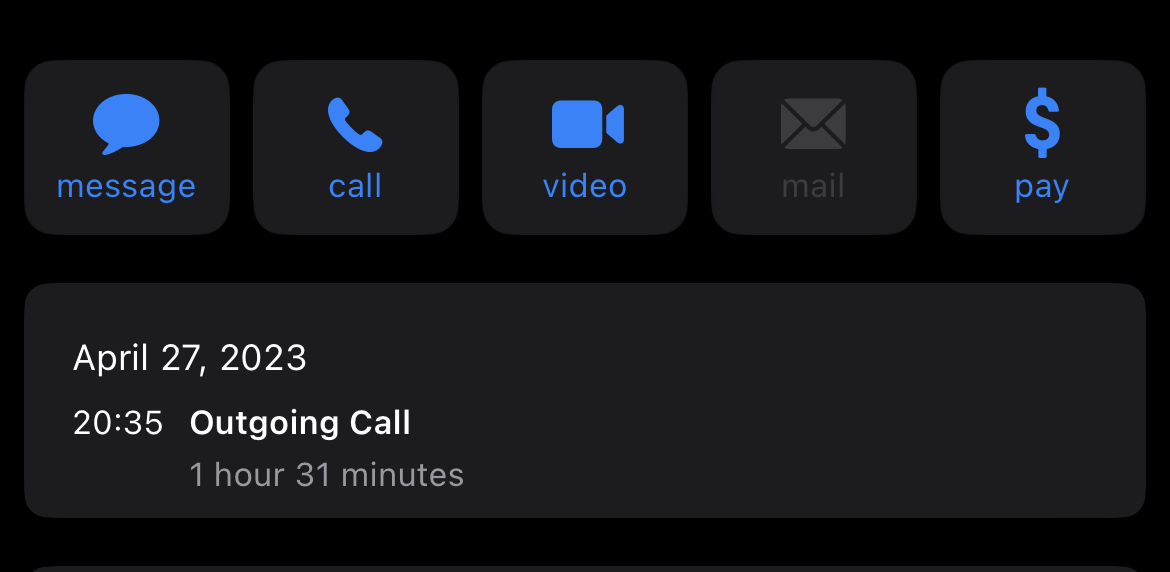

The second convo was a 90-minute phone call that ended way past my bedtime.

If you're not familiar with the acronym FIRE, it stands for Financial Independence, Retire Early.

It's the ultimate goal for personal finance nerds: work hard, save up, invest accordingly, and "retire" while you're young & healthy enough to enjoy the second half of what life has to offer.

But just because you can retire, doesn't mean you want to stop working altogether.

On the contrary, I find the people who have the drive to achieve FIRE, are the same people who are unable to enjoy retirement in the form of sitting on a beach sipping Mai Thais.

So it's no surprise to me that the two conversations I had with these ~50-something overachievers were based on their desire to jump into the world of entrepreneurship.

I found myself saying the same sorts of things to both so I thought I'd recap my "advice" here.

Apprenticeship

The first suggestion I always give to someone who wants to start their own business is to start by learning on somebody else's dime.

There's absolutely no reason to pay for your own mistakes when you can easily work with or for someone who will pay you to make them on their behalf.

This is exactly how I got started in real estate investing.

I worked with Matt Faircloth, of the DeRosa Group, to buy 3 large apartment communities before buying a handful of small multi-family homes on my own.

I also participated in Gabe DaSilva's Learn & Earn Program on this flip before I went and did a new construction deal on my own.

This method is also how we (Dia and I) got a head start on our restaurant business back in 2014.

Dia went to work for another franchisee before we opened our location. She got paid to learn best practices, what not to do, as well as what sold, and what didn't.

She brought all of that information and experience back for us and we hit the ground running.

It's counter-intuitive, but the best first step if you want to "go out on your own" is to find an apprenticeship with someone who is doing exactly what you want to do.

Buy Then Build

We've all heard some form of this stat: 90% of businesses fail within the first 3 years. Of the 10% that survive, 90% of those fail in the subsequent 3 years.

I'm not sure if those are the ACTUAL numbers, but put it this way: I wouldn't be surprised if the truth was worse.

With that said, I don't think I'd ever start a new business from scratch again. At least not one that required a lot of startup capital.

The better play, in my humble opinion, is to buy a business that's been around long enough to defy the odds (6 years+).

The main benefit of buying a business, rather than building one, is that you're paying for cash flow instead of paying for FF&E (Furniture, Fixtures, & Equipment).

For example, when I opened my restaurant, it cost us a few hundred thousand dollars to fit out the space with all new FF&E.

When we closed the restaurant, we did a one-day auction and sold EVERYTHING in the store (including aged inventory) for less than $15,000.

The nuts and bolts of a restaurant are *worthless* if there are no paying customers.

However, if the business was profitable, I could have sold it for 3-4x annual cashflow.

Test Then Invest

Never bet the farm. Or in this case, don't risk your retirement funds!

I quit my 9-5 job in 2014 as soon as I saved up $100K. I bet all of it on a restaurant and proceeded to get my face ripped off.

It would have been faster and less painful if I put $100K in a trash can and lit it on fire.

So how do you "test before you invest"?

Simple - start small:

- Before opening a full-fledged restaurant, maybe do a food truck.

- Before doing a food truck, maybe do a farmer's market.

- Before doing a farmer's market, maybe host a dinner party.

I'm giving a lot of food examples (because that's my main reference material), but this method applies across the board.

For example:

- Before starting a media company, try starting a blog or newsletter.

- Before dumping your life savings into your first fix and flip, try investing $50K into someone else's deal

- Before quitting your job to open a gym, become a personal trainer on nights and weekends.

- Before creating Enterprise SaaS, build a Chrome Extension.

- etc.

Entrepreneurship is a Trip

I'm flattered these two individuals came to me to "pick my brain" about entrepreneurship.

However, I'm not quite sure I did that great a job advertising it.

I'll say it before and I'll say it again: I would not be able to do what I do if my wife didn't do what she does.

I quit my job in 2014, got zeroed out in 2017, and didn't manage to surpass my 2014 salary again until 2022.

Entrepreneurship actually kind of sucks. It's like driving on a long, winding road with a lot of speed bumps.

The obvious next question is, "Then why do you do it?"

The answer is simple: I'm happiest when I'm in a prison of my own making.

I like playing life in "All-Madden" mode. It's hard as fuck to score. But when I do, it feels so damn good.