G'morning to everyone except the people who roll their eyes when they realize a baby has boarded the plane.

It's not gonna be fun for us either, dude.

☀️

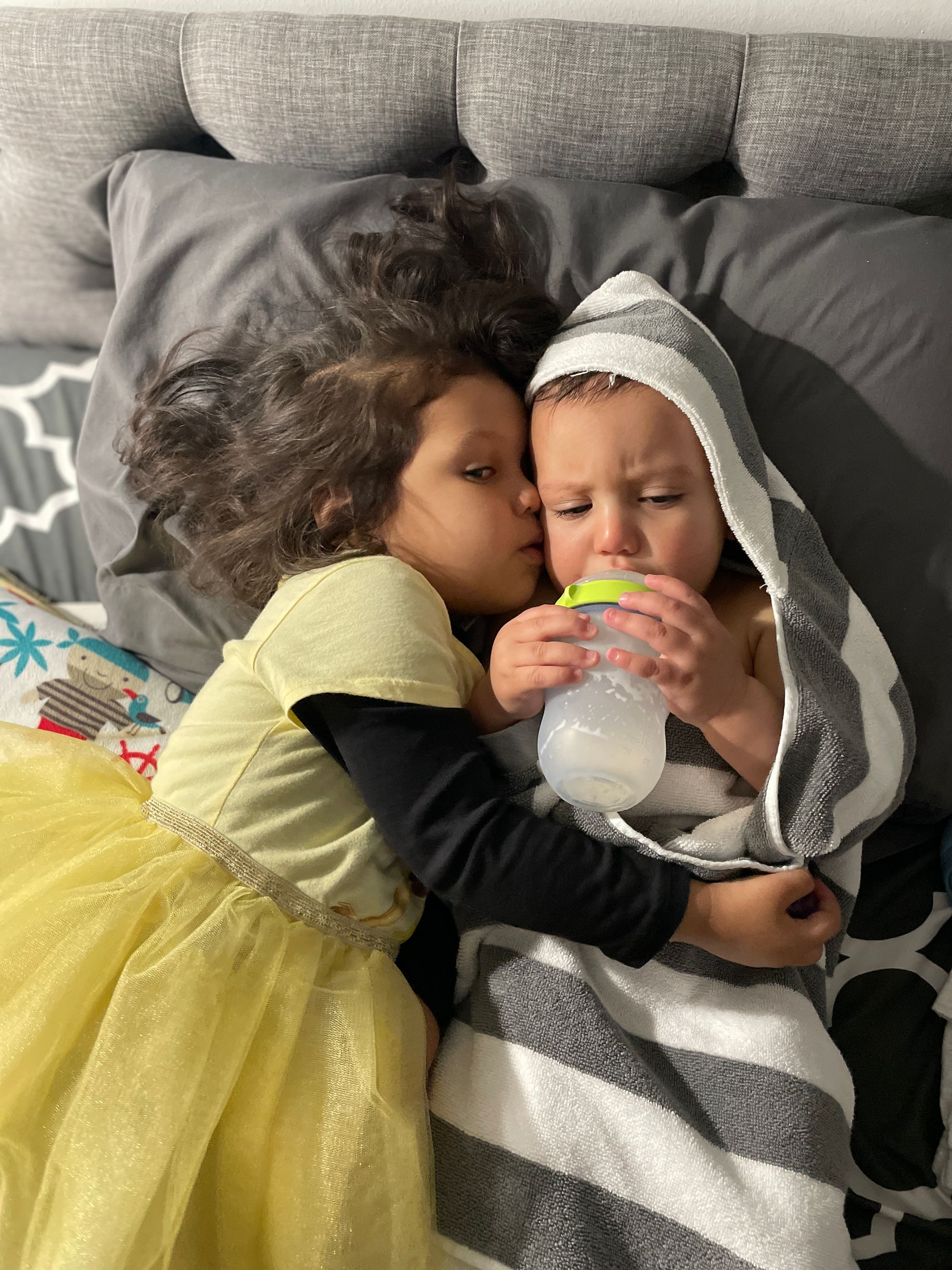

Livin' La Vida Luna y Luca

In December 2022, I bought a fix-and-flip project in Philadelphia: 1532 Catharine

I did a full write-up on the opportunity here: SSS #161: 🚨New Deal Alert: Philly Special🚨

Here's what we got right:

- The reno budget came in at $100K

Here's what we got wrong:

- We couldn't sell for $800K

- We couldn't even sell for $750K 😬

We changed the hero image for the listing and adjusted the price down a little further to $747,500 as a final push to sell.

What Happens Next?

If we don't receive any offers by the end of May, we put a backup plan in place.

We're going to refinance into long-term fixed-rate debt and rent out the house to a tenant who recently applied to live there for $4,500 per month.

We'll try to market the property for sale again when interest rates come down a bit.

The Refinance Numbers

Since we used 100% financing to purchase and renovate this property, we currently owe our private money lenders $660K:

- $500K Purchase

- $100K Reno

- $60K Soft Costs

When we apply for our refinance, we're expecting the property to appraise for $750K.

My DSCR lender's terms are 75% LTV at 6.75% fixed for 30 years.

The new loan amount will be $750K x 75% = $560K.

ICYMI: $560K < $660K by $100K. 🤕

This means my partner Francis and I will have to come to the closing table with $50K each to pay off our current lender. 😭

Lesson: It's cute to talk about investing in real estate with "none of your own money". But for situations like this, you better be able to pay the bill when it comes due. Otherwise you end up having to firesale and lose your shirt in the process.

The Profit & Loss Numbers

Once the refinance is complete, here's what our Monthly P&L will look like:

+ $4,500: Rental Income

- $3,600: Principal & Interest

- $575: Property Tax

- $100: Insurance

= $225: Cashflow

Since the property is newly renovated, I don't expect we'll have any maintenance issues during our ownership period.

We're also requiring the tenant to put utilities in their name so we don't have to eat that cost.

Sentiment

Things didn't go according to plan here, and that's always tough.

But we're not taking an L (at least not yet). We're kicking the can down the road for two reasons:

1) We can. We're not willing to sell for less than $750K. We have the ability to buy ourselves more time so we're doing just that.

2) Based on buyer & agent feedback, we believe current interest rates and inventory in the sub-market are the main contributing factors to the lack of offers received. We think both of those scales tip in our favors in the not-so-distant future.

Documented

The thing about this newsletter is I can't hide my setbacks.

I try my best to be as transparent as possible.

If you go back and read the post I wrote about this project when we first bought it, the vibe was obnoxiously optimistic.

Despite the humbling turn of events, I'm not afraid to double down and put my money where my mouth is.

Hopefully 20, 50, or 100 newsletters from now - I'll be able to say this was a bet worth making.