😆 😂 Can confirm as someone who saw both.

Although, I watched both with Dia. #ForeverMovieDate

☀️

Livin' La Vida Luna y Luca

Pardon our bathroom's appearance. Or the fact that neither kid is wearing pants.

Let's instead focus on Luna teaching Luca how to brush his teeth. 🥲 She literally said, "Lookey, you missed a spot." 💀

What you're about to read is a story I thought I'd take to the grave.

It's one of my biggest mistakes as an entrepreneur.

Actually, it was more like 30 consecutive mistakes that made for one colossal shit show.

Here goes nothing...

It was July 2018. They picked me up in a black-on-black Mercedes Benz S550.

I was instructed to sit in the back (cooling, reclining) seat next to the investor I was meeting that day. He will remain unnamed.

The driver was wearing a suit. We were wearing shorts and t-shirts.

We drove around all day looking at small multifamily properties that were under construction.

The catch? They were all in lower-income areas like East Orange, Paterson, Newark & wait for it... Irvington.

That day alone, we looked at 12 properties - all in varying stages of development - consisting of roughly 40 units combined.

We had a late lunch in Newark. It was some Spanish place that served excellent Seafood Paella.

I was halfway through my dish when the investor asked me, "So how much are you looking to deploy?"

I told him I'd need to do more research and due diligence, but if everything checks out, I'm good for $100K.

We wrapped up our meal and he dropped me off back to my car.

Due Diligence

I spent a full week checking boxes.

I looked up the public record for every address we visited. Each property was held in an individual LLC (123 Main St LLC) that was wholly owned by his holding company (Unnamed Investor LLC).

The records confirmed everything he told me during our tour. He was buying these properties with cash for dirt cheap - 4-family homes for <$75,000. Admittedly, they were in war zones, but the numbers don't lie.

Being all into an asset for <$250,000 that has a Section-8 income of $5,000 per month is a literal gold mine.

Wet My Beak

I decided to wet my beak. I called the investor back and said I'd start by lending him $100,000 on one property in East Orange.

Of all the properties I saw during our tour, it was the furthest along in the renovation process.

I figured it was the safest bet.

He countered and asked me for $200,000 instead. I asked him "Why? It won't take that much money to finish the project."

He said, "I know. I'll use $100,000 to finish this project, and I'm going to use the other $100,000 to lock up 2 other properties."

I said, "OK - but I want to take a 1st position lien for $200,000 against all 3 properties. That way I have $600,000 of protection against my $200,000. I'll give you $100,000 when we close, and I'll drip $25,000 to you in 4 stages as you get closer and closer to the finish line on this East Orange project."

He agreed... too quickly.

My best estimate had the subject property valued at $400K, anyway - so roughly 50% LTV, which is more than enough margin.

We closed on the loan in my Lawyer's office less than a week later.

Honeymoon Phase:

I walked out of that closing with ~$4,000 in my pocket (2 points on $200,000).

He walked out of that closing with ~$90K ($100K - closing costs).

He paid me $2,000 (12% interest) per month every month for 5 months.

In those 5 months, I had also fully deployed the other $100,000 with him. So now my total loan amount to him was $200,000.

Then he missed the 6th monthly payment. After pestering him every single day, he picked back up the 7th month with another $2,000 payment.

He said he'd pay me an extra $3K when he sells the property for the payment he missed.

I agreed...

But that day never came.

6 months of payments ($12,000) was all the money I saw from him on that ($200k) loan.

Damage Control

After another month of not receiving payments, I called my lawyer to see what type of action we could take.

He told me we could start the foreclosure process, but it would be expensive and take a long time. I'd be better off if we came to an agreement.

At this point, the property was finished and fully rented. It was collecting roughly $5,000/month in combined rent from 4 separate section-8 tenants.

I suggested he refinance the property and pay me off with new debt.

The investor said no, citing less-than-ideal credit as a reason.

Then I suggested a deed-in-lieu-of-foreclosure. Just give me the property, and the debt will be forgiven.

The investor said no, (rightfully) saying It was worth much more than the $200K he owed me.

Then I suggested a rent assignment. Have 2 of the tenants pay me rent until the debt is paid off.

The investor said no, as the cash flow would not support it.

This experience was very new to me. I had made half a dozen real estate-backed loans to 3 or 4 separate people prior to this and every single one of them went extremely well. Real Estate is supposed to be easy...isn't it?

The other thing that threw me for a loop was how communicative this investor was. He never had good news for me, but he always answered my call. I remember thinking, "Why isn't he being more evasive? If I were him, I'd never answer the phone."

Keep Your Friends Close...

After multiple attempts to solve the problem, I went back to my lawyer and gave him the green light to start the foreclosure process.

I got a call back the very next day with terrible news. Upon pulling a new title report, my lawyer found out the investor took ANOTHER loan on the property exactly one day before I lent him money.

Keep your enemies closer...

The reason the investor was so communicative with me is he didn't want me fishing around.

And it worked! I didn't find out there was another lender on this project until about 9 months after I originally lent him money.

Negative Equity

The other loan he took was for $280,000. It was a hard money lender out of California, called Velocity Capital. They valued his property at $400,000 and lent him 70%.

He didn't make a single payment to them, so by the time I found out about this issue, their payoff amount skyrocketed to something like $300,000.

So the property (at the time) was worth $400,000, but he had $500,000 of debt against it. $200K to me, $300K to Velocity.

The worst part was I was in 2nd position. Velocity closed their loan one day before me. And even though I recorded my mortgage first, the dates on their documents preceded mine.

My lawyer tried fighting for 1st lien position but it was a fool's errand.

I had a decision to make:

A) I could payoff Velocity ($300K) and reclaim a 1st (& only) lien against the property - or -

B) Wait and see what Velocity would do after 9 months of nonpayment.

Wait and See

I chose to wait and see. Mainly because:

1) I didn't have $300K to pay off them off

2) I was making a conscious effort to not throw good money after bad

3) Velocity Capital is a proper hard money lending company with lawyers on staff that would surely take care of the foreclosure process more quickly and efficiently than my solo practitioner lawyer in Glen Rock, NJ.

4 Long Years Later...

The foreclosure sale (finally) took place.

I made this loan on July 16th, 2018.

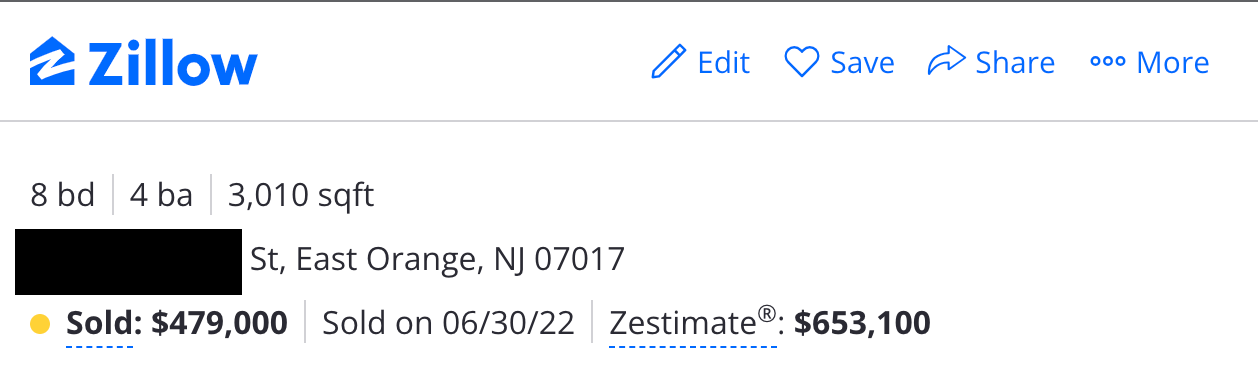

On June 30th, 2022, the property was sold (at auction) for $479,000.

Velocity Capital was owed $365,000.

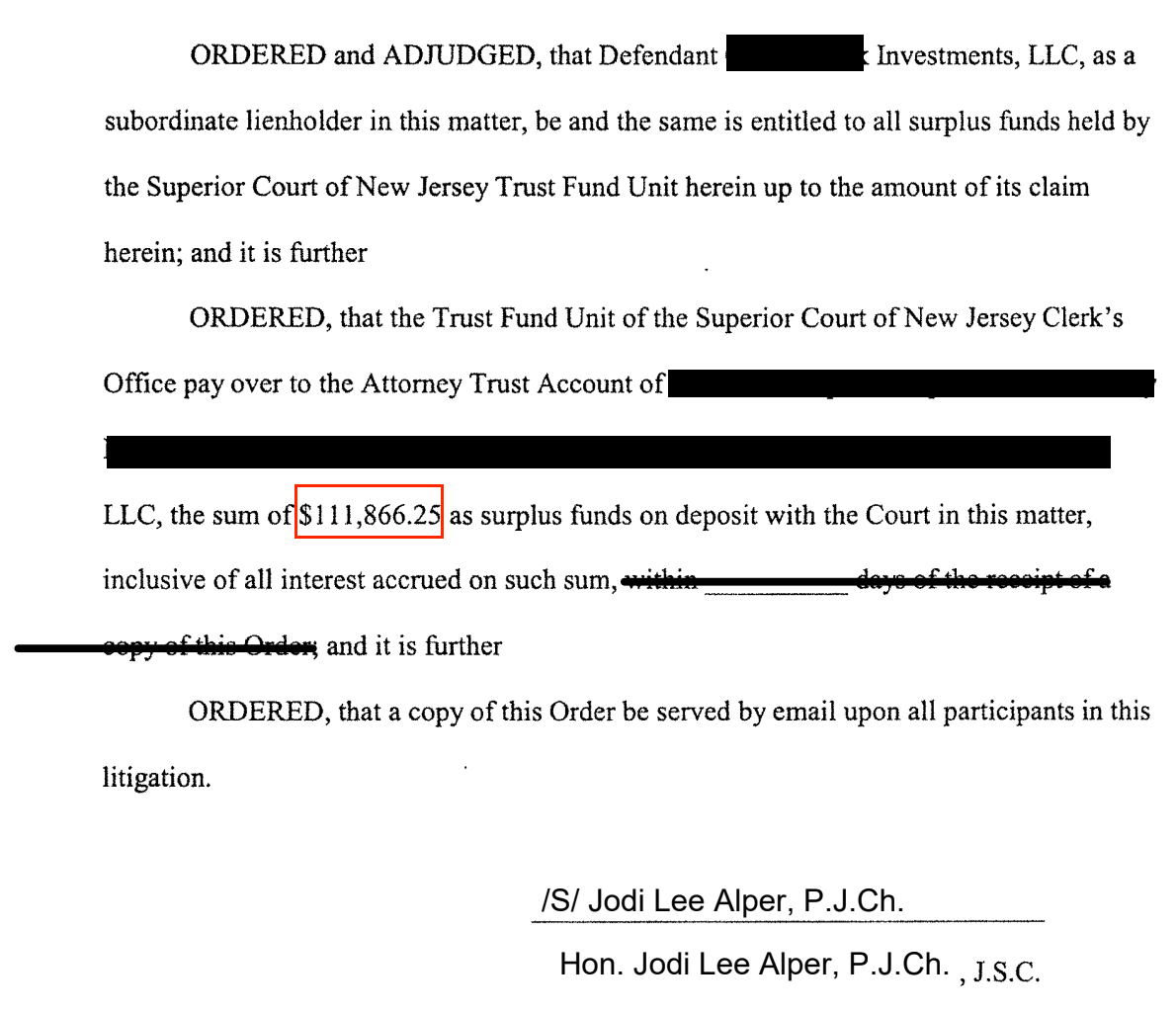

As soon as we were notified the foreclosure sale went through, we put in a petition with the Surplus Funds Trust Account of the State of NJ to send us any excess proceeds from the sale.

More than a year later, on August 3rd, 2023 - I received an Order signed by the Honorary Jodi Lee Alper for the Release of Surplus Funds to my company, the second defendant in this case.

I Know...

I know what you're thinking.

$111,855.25 is about $90K shy of the $200K I lent this asshole.

Still $80K shy if you factor in the interest payments he did make.

It's true - the numbers don't lie. I got my face ripped off on this deal. But it's $80K in education I could not have gotten anywhere else.

No Losses, Only Lessons.

A few takeaways, in no particular order.

1) My lending process is so buttoned up now it's unbelievable. Ask any investor I've lent money to in the past 4 years. If you don't pay me back, I will take your firstborn. If you don't have children, your dog is fair game.

2) I view material success with a grain of salt. Getting picked up and driven around in an S550 was an absolute dream. What I didn't mention was the next time I saw that investor, he was driving a Range Rover with dealer plates. It turned out he owned a used car dealership and just drove the best car on his lot at any given time.

3) Time heals all wounds. I'll admit I didn't expect this process to take 5 years, but I'm glad I waited. The market appreciation almost made me whole. If I had bought out Velocity for $300K and then initiated the foreclosure process myself, I don't think I would have faired as well after legal fees.

4) Nothing worth doing is easy - just varying levels of difficulty. Choose your difficulty.

5) I died on my sword. Most of the $200K I lent this investor wasn't even my own money. Roughly 80% of it came from private investors. I was paying them 8% while he was paying me 12%. I was banking a nice 4% spread on $160K and calling it a day.

4% on $160K is ~$550/mo. Guess what $550/mo is good enough to buy? That's right, a brand new Tesla Model 3. Guess what happens when the music stops? The Model 3 gets sold to a stranger on the internet.

In addition to selling my car, I wrote off the loan to realize a $200K loss on my tax return in 2020 to free up some cash. The last chess move was to sell my 4-unit mixed-use commercial building to make my private investors whole.

6) Work with the best. If you think hiring a professional is expensive, try hiring an amateur. The lawyer I used for this transaction did not specialize in real estate loans. I abandoned him and found someone who ONLY works with private money lenders.

7) Extreme Ownership. There are two ways to look at this situation.

A) I got swindled and I'm a victim - vs. -

B) I got swindled and I'm a dumbass.

I choose the latter. I may not be responsible for what happened (my lawyer kind of fk'd up by not knowing about the other closing and the investor is clearly a fraud), but I was the only one who paid for the mistake.

8) Don't chase yield / if it's too good to be true, it probably is. I had made a handful of loans prior to this one. They ranged from 8-10% interest. This particular investor didn't hesitate when agreeing to 2 points and 12% interest during a near-zero interest rate environment. The moment I was fully deployed with him, he stopped paying his interest bill. 🤦

9) All I need is a chip and a chair. For me, entrepreneurship has been a game made up of outsized wins and capped losses. I'm not ashamed to admit this $90K isn't even the most money I've lost on a single deal. My attitude is: as long as I have a single chip in my stack and a chair to sit on, I'm confident enough to play another hand. Just shuffle up and deal.