My very first new construction project is coming to a close.

We're targeting a list date of September 5th and an open house on September 10th.

Saying these dates out loud is surreal - Let's see if they actually happen.

☀️

Livin' La Vida Luna y Luca

We celebrated Raksha Bandhan a little early this year.

Thinking about changing Luca's name to Lucky. Because that's what he is - to have a sister like Luna.

About a month ago, I was complaining to my investor buddies on our weekly Zoom call.

I'm nearing the finish line of my new construction project, but I don't have anything in the pipeline.

To find my next deal, I had a few options:

- Turn on direct mail marketing (again)

- Partner with someone who had a deal, but no money

- Reach out to everyone I know with deal flow

I really didn't want to go through the hassle of turning on direct mail again so I focused on reaching out to the movers and shakers in my network.

I sent texts and made calls to anyone who would give me 15 minutes.

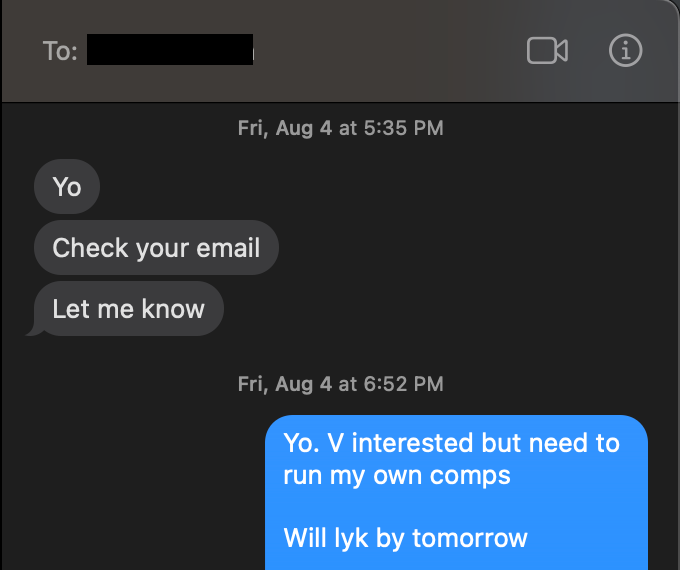

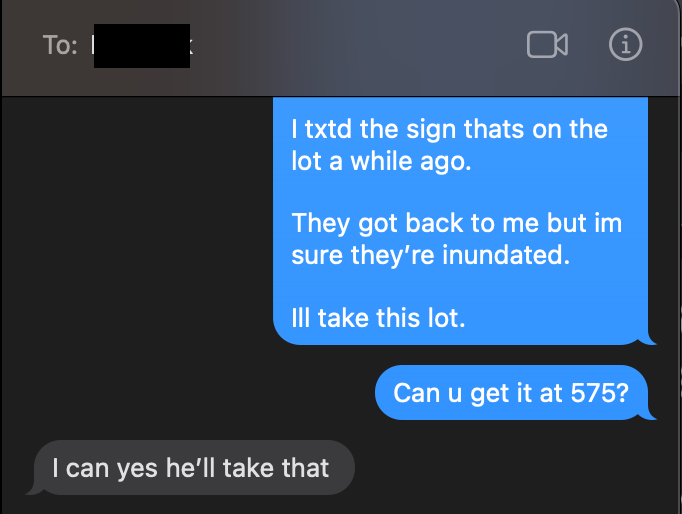

It didn't take long before I received the following text:

This was the email he forwarded me from a local wholesaler.

After driving the area, running the comps, and considering the cost of my current project, I couldn't get myself to pay their asking price.

I offered $525K, but they weren't willing to come down. 😢

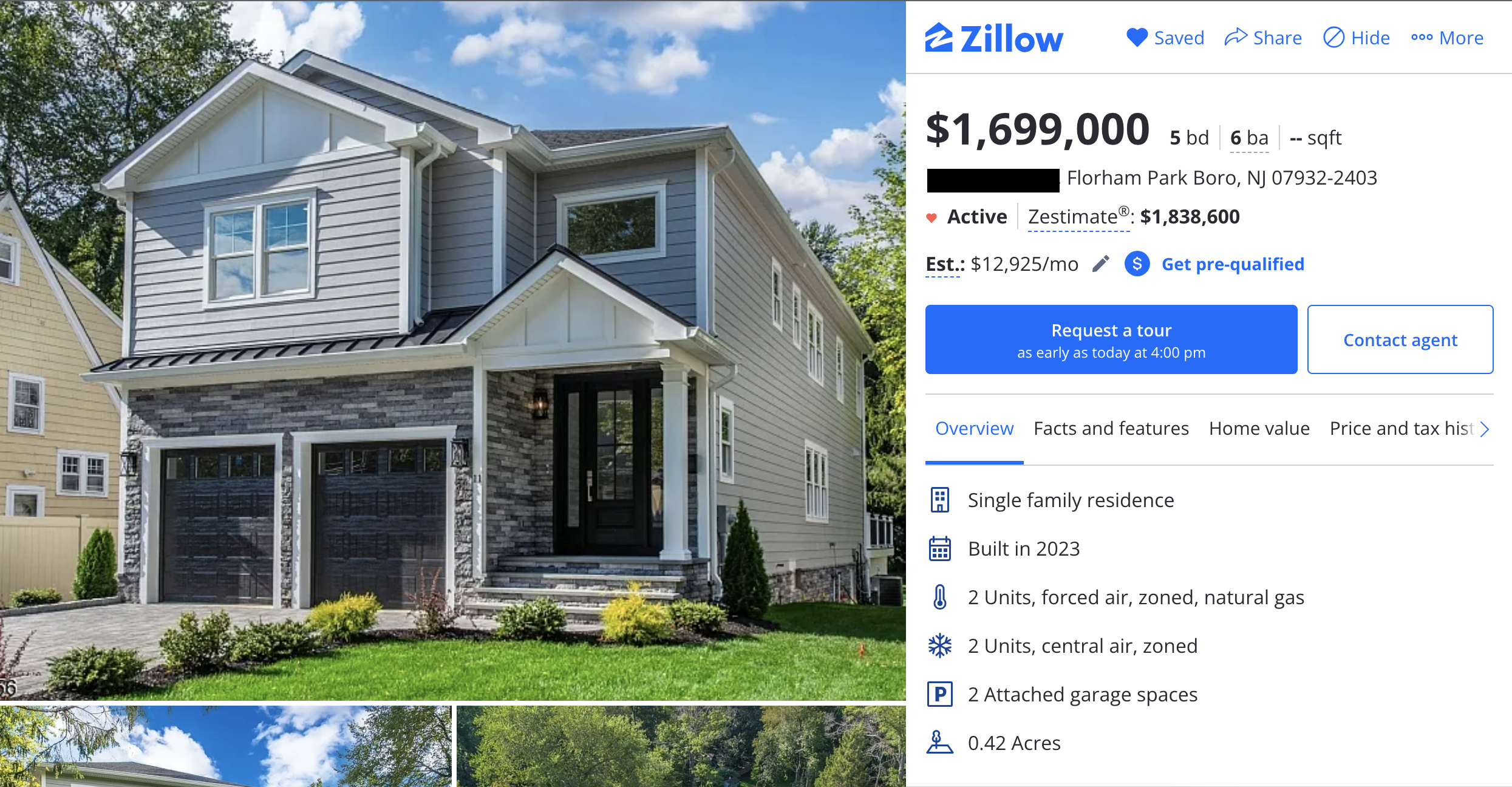

Then this new construction house was listed for sale on the same street 2 days later:

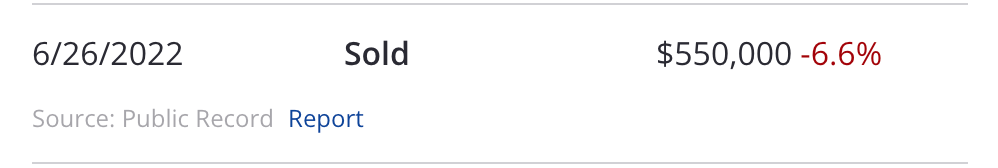

The developer bought it last summer for $550K.

And I have this character defect where I tend to think, "If they can do it, so can I."

So I called the wholesaler back and bumped my offer up to $545K.

Now I'm under contract to purchase this lot. 😁

There Are No Coincidences

After locking in the deal, I went to tour the new construction home in the picture above with my agent, Amanda.

As we were leaving, the builder pulled into the driveway.

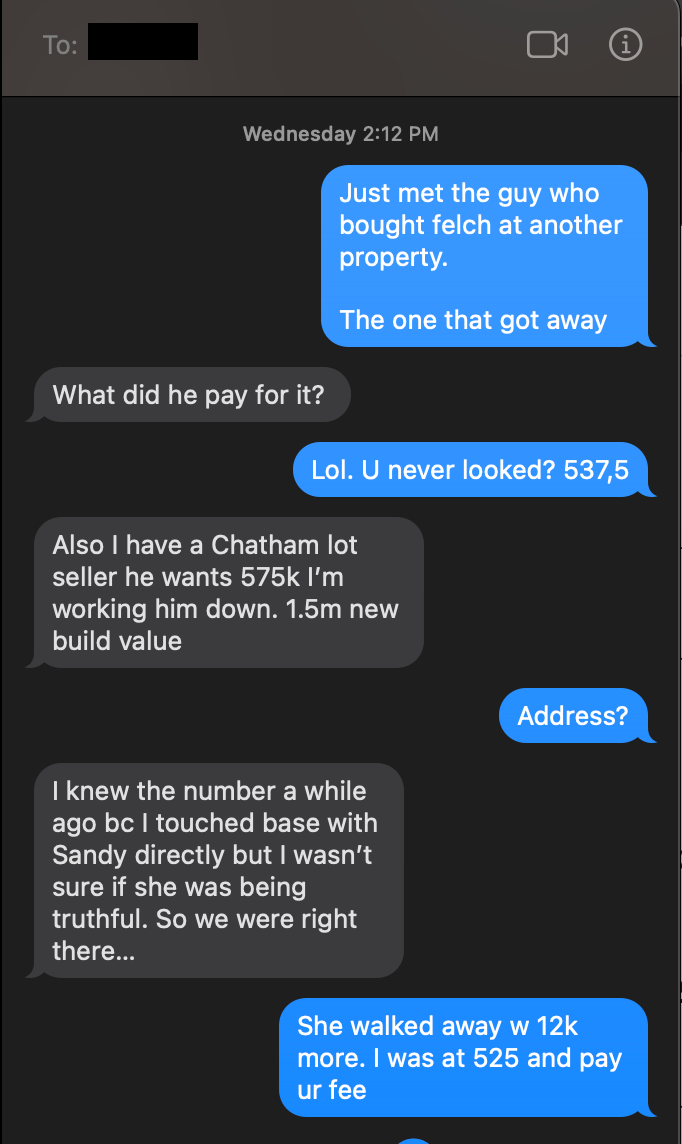

After some small talk, we asked if he was building anything else in town. He said, "Yes, I'm about to tear down 2 Felch."

Hearing those words felt like a punch in the stomach.

2 Felch was the house I tried to buy back in December, but the seller's attorney killed the deal.

Anyway, after leaving that house, I texted my business partner, Bill. He's the person who brought Felch to me.

Texting Bill about the deal that got away led to another opportunity.

I jumped on it faster than Joey Chestnut can eat a hot dog.

So in the span of a week, I went from having nothing in the pipeline to 2 new construction projects in my back pocket. 😜

What's Next

The combined purchase price is $1.12M. If nothing pops up during due diligence, I'm going to need to raise about 50% of that number in order to fund the down payment (20%) and working capital (30%).

Then, I need to identify whether I'm going to hire a builder or do a joint venture with an operations partner.

This Is My Favorite Part

It's worth mentioning that I'm going to be jumping out of bed every morning for the next few weeks because this is my favorite part of being a real estate investor.

I love all of the stuff that happens between finding a deal and getting it to the closing table.

The next few weeks will be full of analysis, due diligence, and conversations with investors, lenders, engineers, architects, and township officials.

Once I buy the properties, I'll hand it over to someone who will manage the projects so I can crawl back into my cave to hibernate for the winter.