Quotes of the week:

☀️

Livin' La Vida Luna y Luca

We celebrated the kids' birthdays last weekend with friends and family.

4 & 2. Wild.

Your boy is at it again.

It's only May and I'm locked into 3 project starts for the year. There may or may not be more coming down the pipe. 🤫 🤐

Current Status:

Our scheduled closing date is August 31st, 2024.

The sellers are in their 80s and moving into a senior living facility. They're taking their sweet time with the transition.

Which works for us!

They've been amenable to letting us get all of our ducks in a row before closing. We already got the survey, tank sweep, and architectural plans done.

R&D: Ripoff & Duplicate (Myself)

Project Fairmount is inspired by what we did at Project Washington.

Although we set a record for the neighborhood with the sale of Washington, my partner and I believe there's room for improvement.

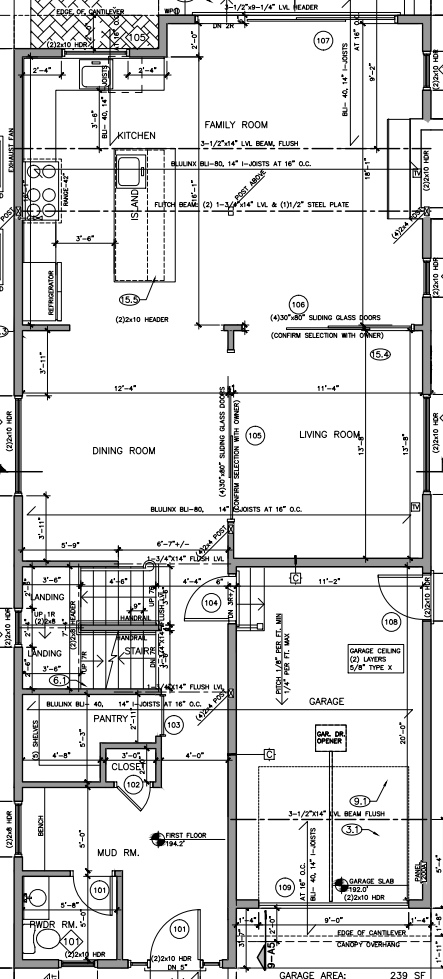

Here's the first floor from Washington (old project):

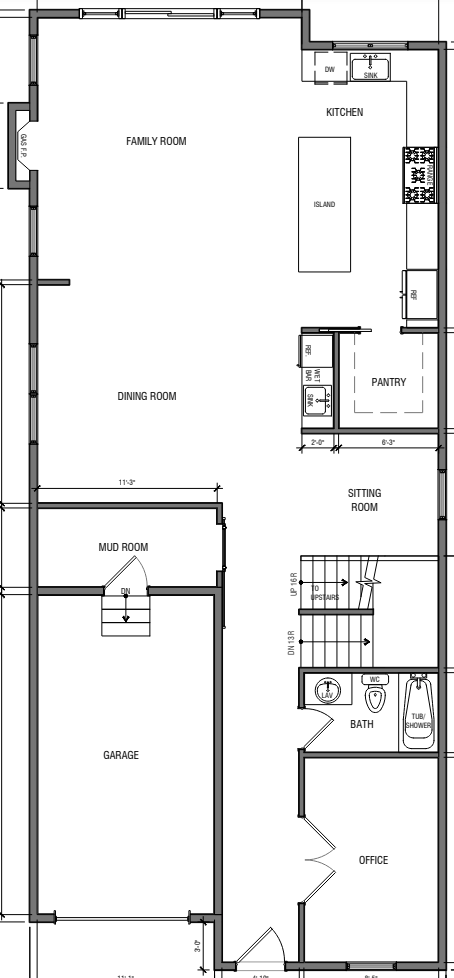

And here's our proposed floorplan for Fairmount:

The major changes:

- Added an office (w/ French Doors)

- Converted powder to a full bath so the office can double as a guest room

- Killed the "Living Room" and converted it to a Small Sitting Room

- Moved Mudroom adjacent to the garage

- Moved Walk-In Pantry adjacent to the kitchen

- Added a Butler's Pantry

Not shown in the image above:

- Office will have windows on the side of the house as well

- Office will have direct access to full bath

- Transom Window in Shower

- Window at the stair landing

- Garage & Mudroom will be slightly longer

- 9' Ceilings Throughout

The Numbers:

Let's quickly run through the numbers here.

We'll start with three buckets of expenses and end with our expected After Repair Value.

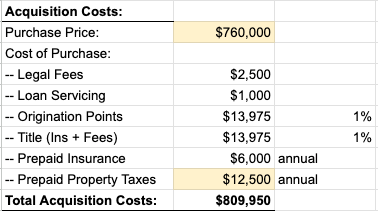

Cost to Buy:

The acquisition costs come out to $810K

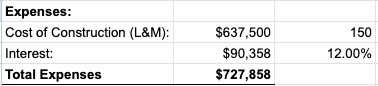

Cost to Build:

We expect to spend $730K on the build (including carry).

We expect this house to be 4,250sf of finished space including the basement and attic.

An average build cost of $150/sf brings us to just under $650K on Labor & Materials.

This is essentially the same budget we have for Project Hillside.

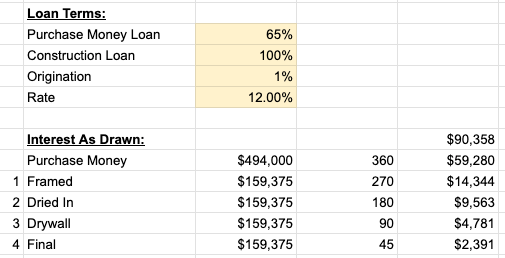

The interest portion is based on the following table:

We should be able to outperform these loan assumptions. For reference: we are closing Project Silver Spring in a few weeks at 70% of purchase and 100% of construction at 0 points and 11.65% interest.

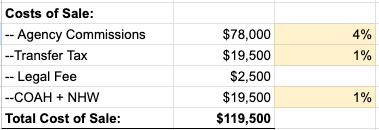

Cost to Sell:

The last expense bucket is the cost of sale, which we project to be $120K.

After Repair Value:

We set the comp in this market. 😤

Washington sold for $2,010,000.

In the spirit of staying conservative, we underwrote to $1,950,000.

What's Next?

We have quite a bit of time on our hands.

Over the next 4 months, we will submit for building permits, finalize our hard money loan, and look for more deals.

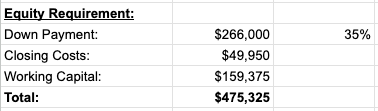

Get Involved!

The cash requirement to fund this deal is $475K.

I'm keeping half of it for myself and looking for a private money lender to take the other half.

If you're interested in participating, please shoot me a text, reply to this email, or schedule a call with me by clicking here.