☀️

Livin' La Vida Luna y Luca

Outdoor pool szn is upon us.

Grift-Proof

It was a controversial week on X if you're in the #ReTwit community.

A handful of anonymous accounts were trying to discredit some large real estate operators that are Twitter Famous.

They attacked a handful of popular syndicators and fund managers who (continue to) raise money from their following.

I don't know what's true or what's not. I do, however, hope these anon accounts look into me because:

- I've raised money through Twitter 💰

- I have nothing to hide 😤

- I can use the exposure 🤣

In the spirit of transparency, I want to do something I've never done before.

I will share the entirety of my real estate portfolio as it stands today.

There are 4 Buckets:

- Under Construction (includes 1 Under Contract)

- Long-Term Rentals (financed via long-term fixed rate debt)

- Debt Positions (Projects I'm lending money on)

- Syndications (Limited Partnership Positions)

5 Under Construction

Hillside

Block foundation walls are complete and we just poured the concrete slab this past Friday (not pictured).

This week we will waterproof the foundation and then backfill the dirt.

We start framing next week. The goal is to be roofed and wrapped by Independence Day.

Baltimore

We installed new windows (not pictured) and finished rough plumbing, electric, and HVAC in our 5-unit project in Philadelphia.

After we pass inspections, we'll move on to insulation and drywall.

We called the lender to issue our first construction draw. The inspector came out on Wednesday and said to expect roughly 40% of our holdback, which equates to $180K. That'll be enough funding to get us to trim, tile, & paint.

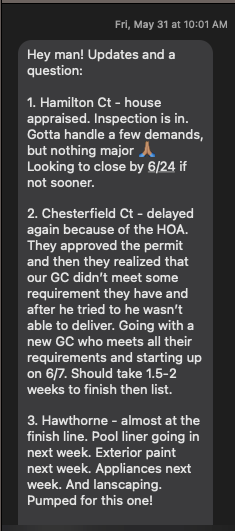

Silver Spring

We closed on Project Silver Spring on May 29th.

We submitted for construction permits within a week of closing, which is a record for me.

My partner on this project is running a tight ship. We've had most (if not all) of our trades walk the house after closing to firm up their bids.

We've also been getting multiple bids on windows, cabinets, and other high-ticket items.

This project will devour money if we let it.

We have to be careful not to go too over the top. For example, we expect to spend $50K on windows and $100K on the kitchen. 😅

Front

Our condo conversion project has been somewhat of a lame duck.

We're into this project for $950K across both units. The larger unit was appraised at $800K and the smaller one at $400K. Sounds great on paper, but it didn't translate to the market. We were listed at $650K and $365K, respectively and couldn't find a buyer.

So we pivoted and rented out the larger unit for $4,500/mo back in April. That bought us some flexibility with our hard money loan, which expires at the end of this month.

My new plan is to convert my equity in this project to debt and sell my 50% ownership to a new partner for $1.

My existing partner and his new partner will refinance both units at 70% of their appraised values and hold until rates come down. When they refinance, I'll get my equity out and redeploy into another project.

Oliver

We're scheduled to close on Project Oliver this Friday, 6/14.

I'm having a timing issue with funding so I asked an old friend to help. He's extending me a line of credit to bridge me to close. I have 6 months to pay him back, but I'll get it done in the next 90 days.

More on how I'll do that a bit later.

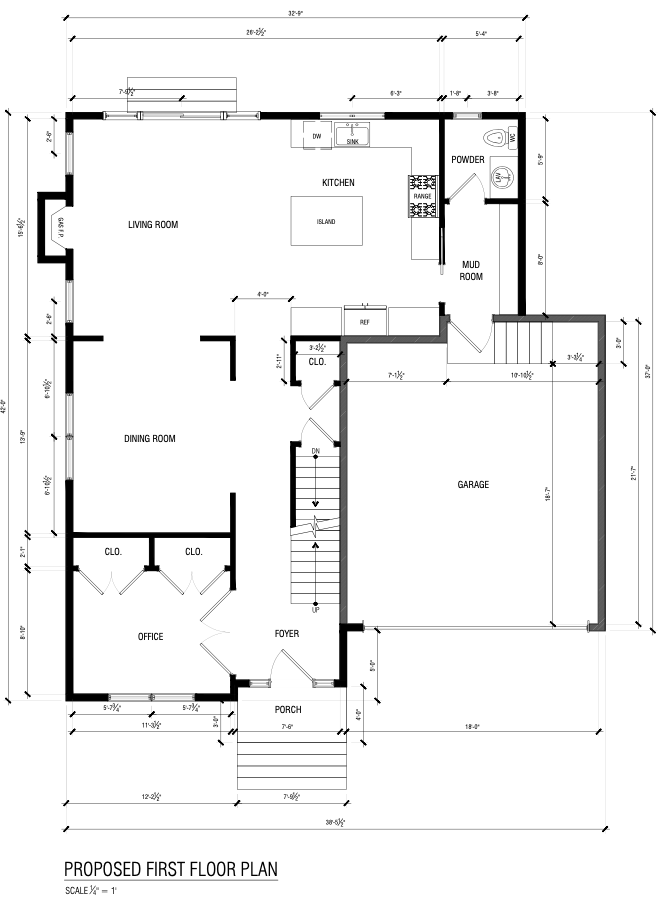

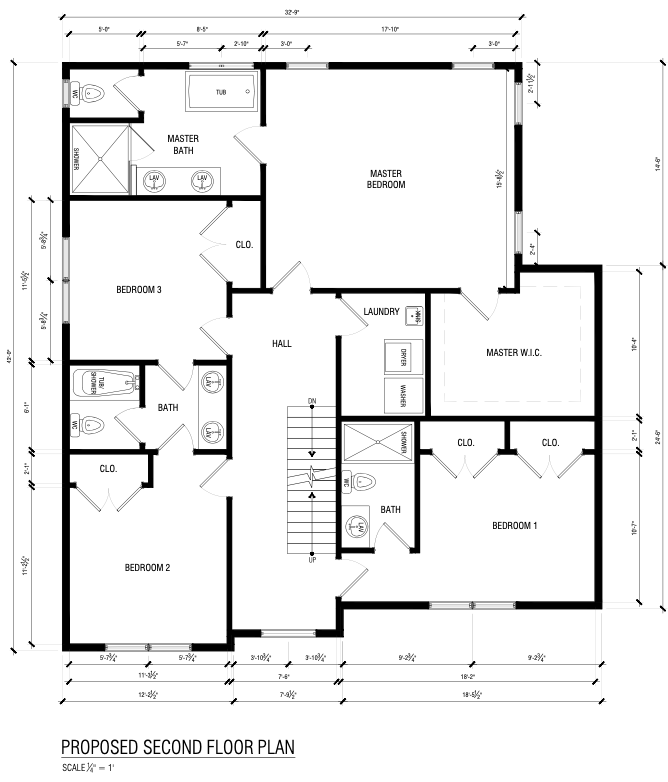

The floor plan is almost finalized. If you have any feedback, I would love to hear it.

Fairmount

Project Fairmount is on the back burner for now. We're scheduled to close in late August.

Our floor plan is pretty much complete. We just need to touch up some final items and then submit for permits.

3 Rentals:

Catharine

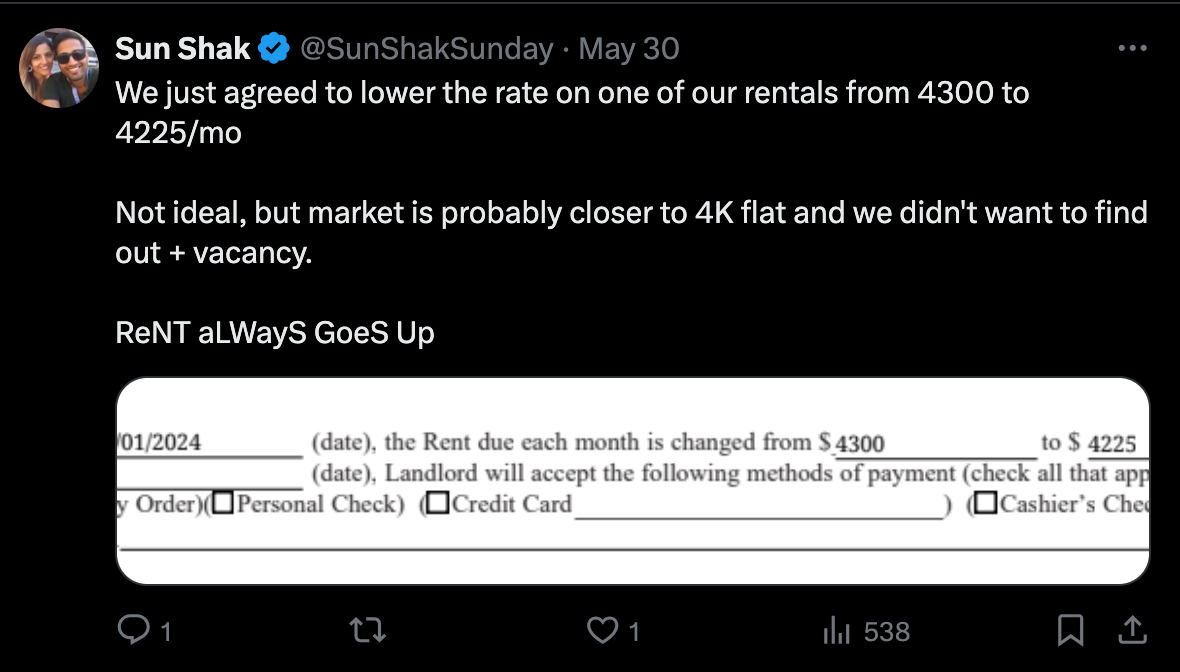

Our tenants just renewed for a second year. However, they finessed us for $75/mo after showing us the rental comps.

We figured it would be easier to eat the $900 annual decrease in rental income than the cost of refreshing the unit + vacancy.

Champion & Walnut

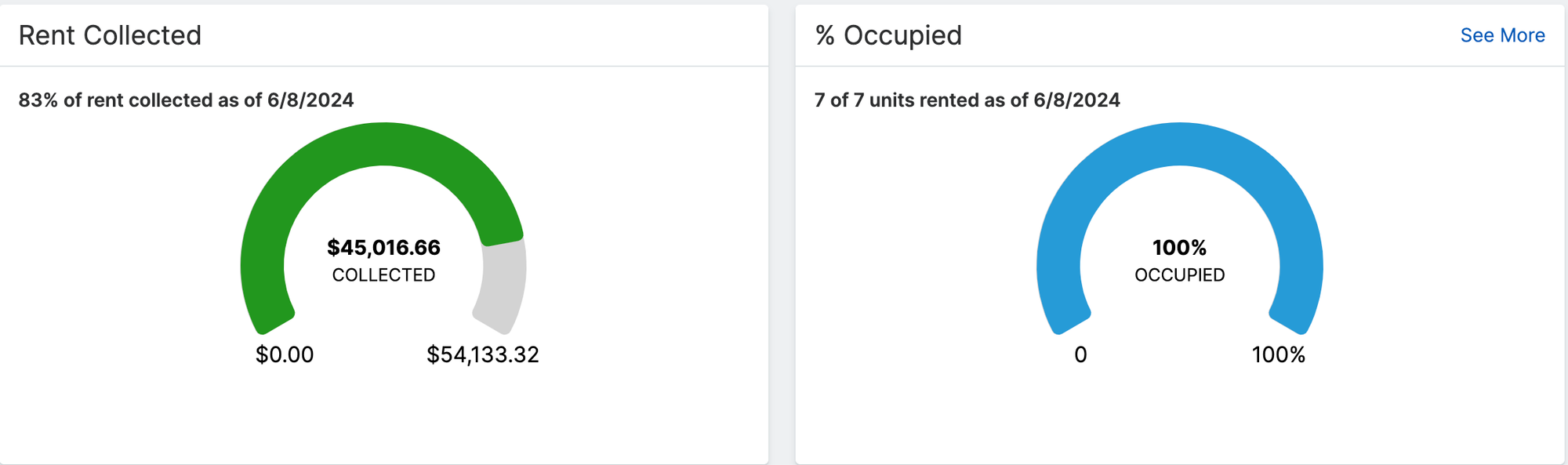

Not much to report here. The 7 units between these two properties continue to pay for themselves, despite multiple tenants being in arrears.

Every unit is rented, but we've only collected 83% of what's owed YTD.

3 Private Money Loans

I lent a friend money on 3 projects a few months ago.

If all goes according to plan, I should be getting ~1/3rd of my money back by the end of June, then another 1/3rd by the end of July, and the final 1/3rd by the end of summer.

~Half of these funds will go towards paying off the line of credit I'm getting for Oliver closing.

I'm often asked why I lend money if I also borrow money from people to do deals.

I don't have a good answer for this.

I think it comes down to timing and my inability to say no to yield. If I'm sitting on cash and someone brings me an opportunity to generate a return, it's really hard for me to say no. Bird in hand.

5 Syndications

I'm a limited partner in 5 syndications. 2 are large multifamily (~200 units each), 1 is a mid-size multifamily (40 units), and 2 are industrial space.

I mostly made these investments for tax purposes. Every dollar you invest in a syndication typically generates .08 cents in annual cash flow and .50 cents in write-offs. It's much less than that now that bonus depreciation is phasing out, but I got in while the bonus depreciation was 100%.

So let's say you invest $100 into a syndication. You can expect to earn $8/year (8%) in cash flow and at the end of the year, you'll get a tax return for -$50 because of the bonus depreciation.

It's a parlor trick reserved for people who qualify as professional real estate investors (which is pretty difficult to achieve).

Grift-Free-Guarantee

Warren Buffet says, "It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently."

I'm ~7 years into my career as a real estate professional and I've been raising money from friends, family, and strangers on the internet since my very first deal.

I've never missed a monthly interest payment. I can't afford to. Another thing I can't afford to do is overextend myself. I want to always be in a position where I can reimburse my private money lenders with my own money if shit really hits the fan.

I'm trying to generate alpha for my investors while keeping their investments as safe as possible. Most of the people who invest with me know where I live, are related to me, or have known me for 20+ years. I also always sign a personal guarantee. So if the project (LLC) flops, I'm still on the hook personally.

Bet on me. I'm a sure thing.