Livin' La Vida Luna y Luca

Fed Cuts 50 Bps

The Fed cut rates by 50 basis points (one-half percent), and the stock market is ripping.

Yay... Right?

Before we get into what this means for us. Let's do a quick history lesson.

This is the first rate cut since March 2020.

The Chairman of the Federal Reserve, Jerome Powell, cites inflation being under control (2.xx%) and a softening job market as two reasons for the drastic cut.

Some pundits say there are more rate cuts ahead (land somewhere between 2-3% by the end of 2026) despite most major indices at or near all-time highs.

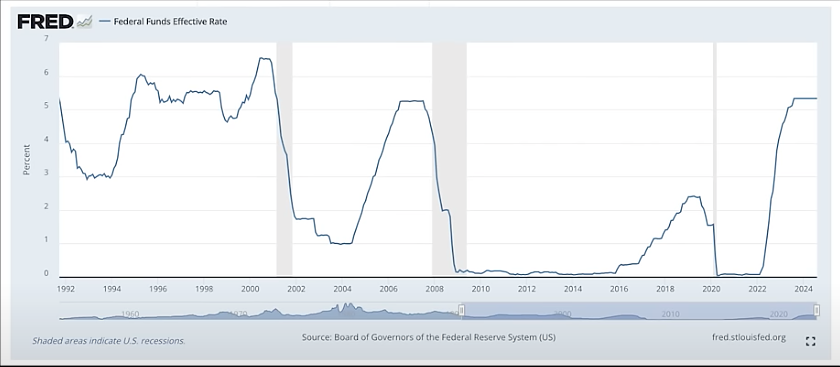

The Fed started publicizing interest rate changes in 1994. Since then we've had 6 rate cut cycles including the one happening now.

Here's where things get a little interesting.

In 1995, 1998, & 2019 the first rate cut was 25bps.

In 2001, 2007, & 2024 the first rate cut was 50bps.

2001 was the dot com bubble and the market fell ~31% over the following 2 years.

2007 was the Great Financial Crisis and the market fell ~26% over the following 2 years.

So the two other times The Fed cut rates by 50bps was immediately before our two most recent recessions.

History doesn't always repeat itself, but it does tend to rhyme.

During the rate cut announcement, however, Powell said he saw no sign of an elevated likelihood of a US economic downturn.

I mean, wtf else is he gonna say? The house is burning down? Get out while you can!

How Does This Affect Me?

It's been less than a week, and I've already had a dozen+ spontaneous conversations about the rate cut.

They all tend to start like this, "So you must be happy rates are finally coming down. That's good for real estate, right?"

... Honestly, I'm not so sure.

I'm seeing two things in the market right now that are hard to explain, but I'll try anyway.

- The Rate Cut Was Priced In

My friend is buying a new house and he's had offers accepted on two separate properties in the past 90 days. He's been keeping me in the loop on his financing, and a few weeks ago we noticed a meaningful drop in the 30-year fixed rate. This was a good 3-4 weeks before the actual rate cut.

I'm semi-worried that retail buyers are expecting the 30-year mortgage to drop again and if that doesn't happen, they'll decide to "wait and see".

Which brings me to my second point.

- People are hesitant to catch a falling knife by its handle, but they'll happily grab it by the blade if it's coming up towards them.

Ok, that was a little graphic, but the point is valid.

When the 30-year mortgage rate tripled back in 2022, people were losing their shit trying to buy houses. My good friend and Realtor, Amanda, listed a ~dozen houses that year and ALL of them sold well above the Asking Price with minimal contingencies.

Now that rates are on their way down, I'm seeing homes that would otherwise get snatched up immediately collect an unreasonable amount of Days on Market.

When combined with #1, this Wait and See attitude can be pretty damaging to investors. Because if the cut is priced in well before it actually happens, people are just going to keep delaying their purchasing decision.

Vicious cycle.

How Am I Moving Forward?

The short answer is more of the same.

I'm going to continue DCA'ing into the market through our tax-advantaged retirement accounts. Our time horizon is long enough (~30 years+) that even if the market takes a dump over the next 2 years, we'll be OK.

As far as developing real estate goes, I'm only doing bread-and-butter deals. I'm sticking to the markets I know and the project types I have a handle on.

This isn't an opportune time to take on additional risk.

What I'm Working On...

Whenever you're ready, there are 3 ways I can help you:

- Templates: I use a lot of customizable templates in my business. You can download them for free (pay-what-you-want) on my Gumroad Page.

- Consulting: If you're stuck in your business or real estate-related activity, I might be able to help. Book a call with me today. If you hate my advice more than stubbing your toe on the leg of your dining room table, there's a 100% no-questions-asked money-back guarantee.

- Passive Income Opportunity: I help people convert their excess active income into passive income with a strategy called Private Money Lending. If you have $100K+ in liquid assets, book a call with me to learn more.