Livin' La Vida Luna y Luca

2024 Personal Finance Review

I started my 2023 Personal Finance Review off by sharing two conflicting ideas.

- Ramit Sethi, author of I Will Teach You To Be Rich, says "There's no virtue in living a smaller life than you have to."

- James Clear, author of Atomic Habits, says "Save more money than you think you need. Life is unexpected and your future tastes will likely be more expensive. Not worrying about money tomorrow is worth more than whatever you could buy today."

From my perspective, both can be true: Live a rich life today, live a richer life tomorrow.

Well, that belief manifested in 2024 cause we spent a boatload of money. 😬

Transactions

Transaction Count is the "Screen Time" of Personal Finance. Right now, we're averaging 6.5 transactions per day. Obviously, that includes transfers between accounts and paycheck deposits, but I assure you those are few and far between.

I'd estimate 95%+ of these transactions are monies going out.

We can probably afford to swipe our cards a bit less in 2025.

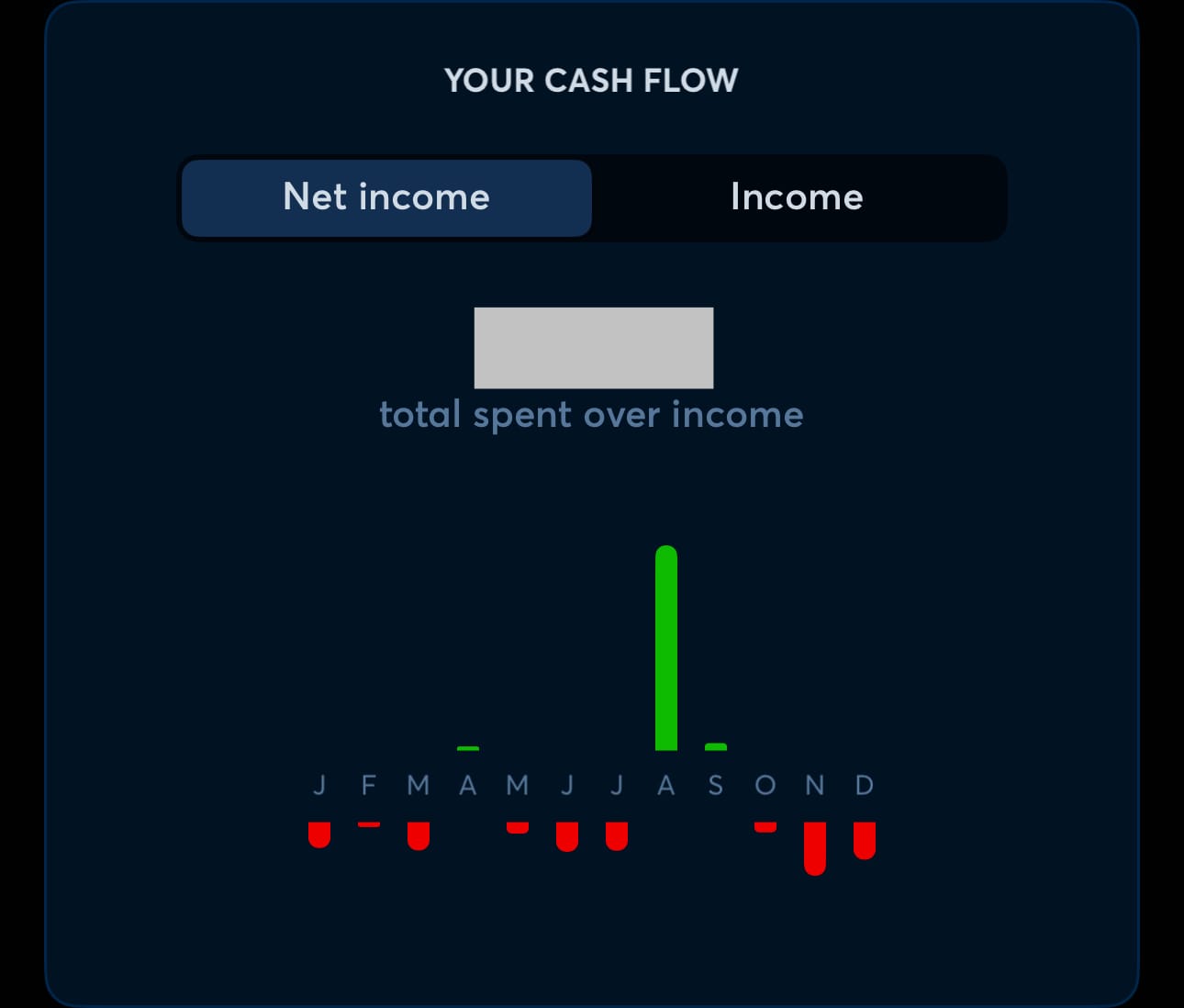

Cashflow

From a Profit & Loss perspective, we had negative operating income in 2024. In other words, we spent more than we brought home.

Not by much, but negative nonetheless.

There were 5 months (Feb, April, May, Sept, & Oct) where we pretty much broke even. There were 6 months (Jan, Mar, June, July, Nov, Dec) where we were really negative.

August was our cash cow. That's the month I sold a great project to another investor. I wanted to take it down myself, but I'm glad I didn't. That cash infusion solved our liquidity problems for the second half of the year.

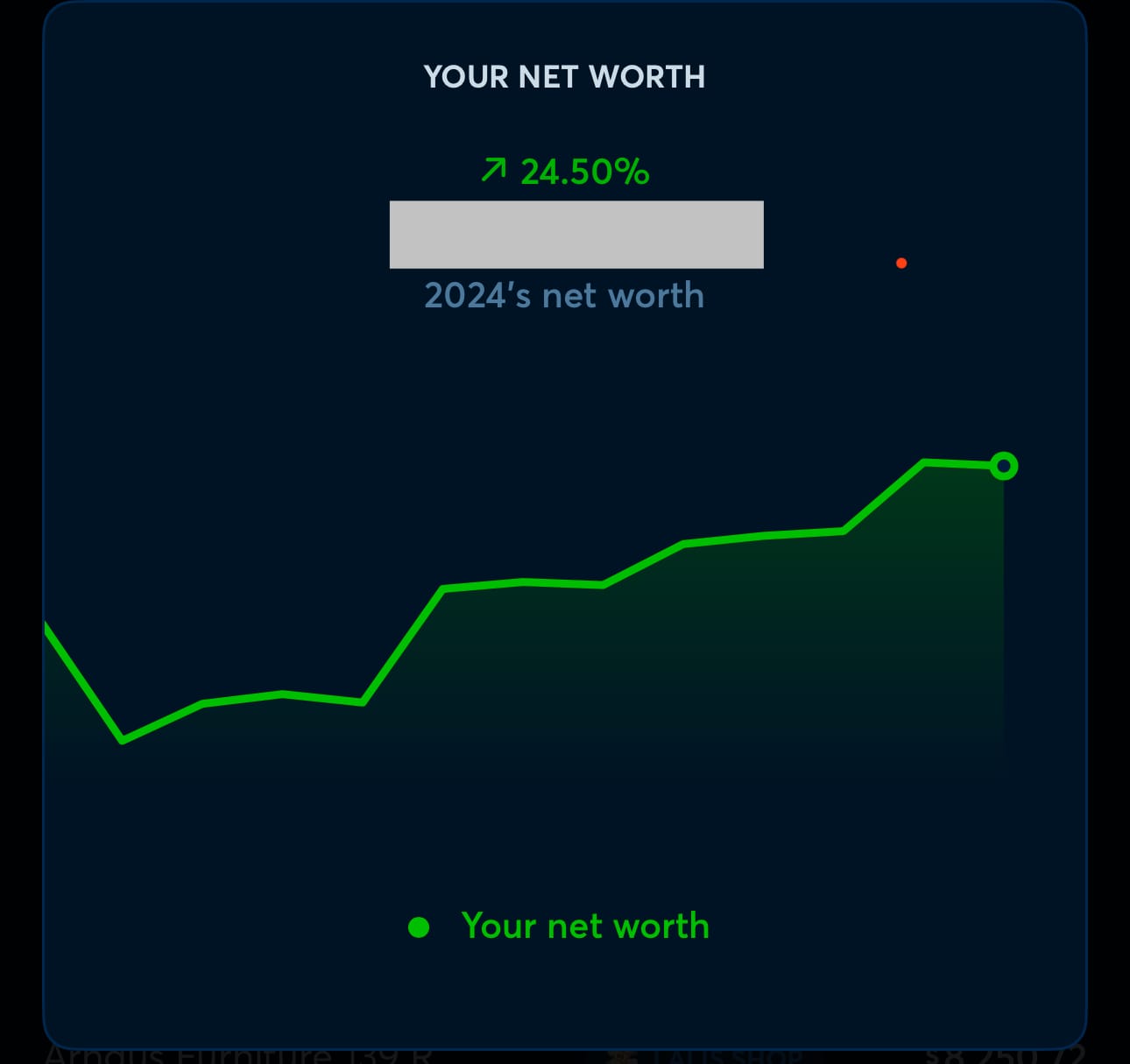

Net Worth

Our net worth grew by 25% in 2024 despite a negative net operating income.

How does that make sense?

Well, we just kept adding to the asset column of our balance sheet:

- My SEP IRA

- My Coinbase (BTC) Account

- Dia's 401(k)

- Family HSA

- Kids Brokerage Accounts

We have automatic transfers for each account to buy Fidelity's Total Market Index Fund (FZROX). The Index was up 20%+ in 2024.

This is not investment advice, but there's more inflation coming. I'm going long equities and housing. The water's warm. Jump in.

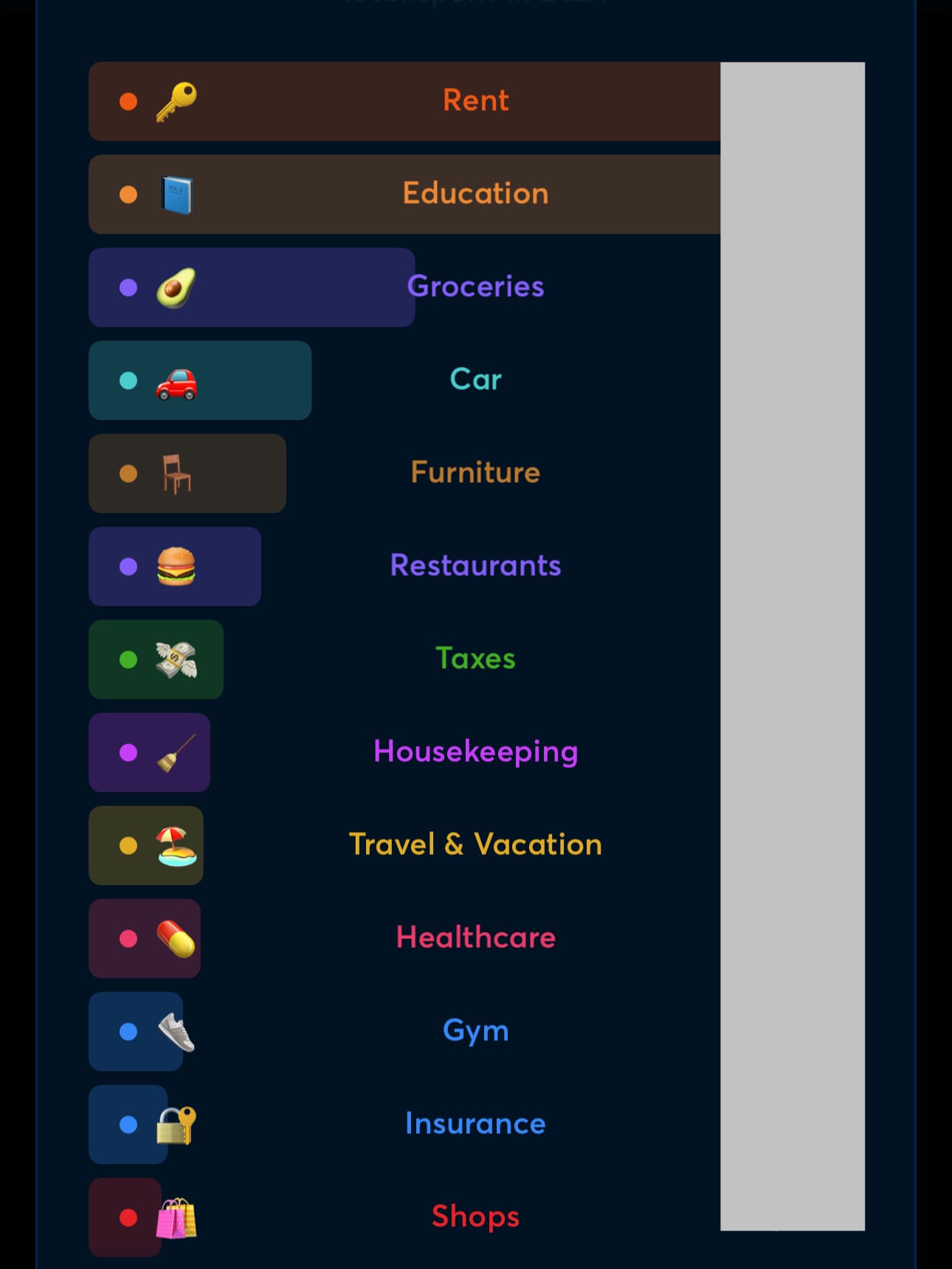

Expenses

2024 Expenses

Surprise, Surprise: Rent & Childcare are at the top of the list.

Stat I'm Most Proud Of: Groceries is almost 2x Restaurants. Before having kids, that ratio was reversed. I think up until Luca was born we were 1:1 on groceries and restaurants. This year we really embraced making food at home. Super proud of this.

Looking Forward

Here's what I think is going to happen in 2025.

Cashflow: We'll be net positive 4/12 months

- Hillside sale is in Feb/March

- Silver Spring sale is in May/June

- Oliver sale is in July/August

- Fairmount sale is in Sept/Oct

Net Worth: Goal is to increase by 40%.

- We'll continue DCA'ing into the market, but most growth will come from project sales.

Expenses: Will likely go up again.

- Our groceries to restaurant ratio will hold strong

- We're looking to move and the rent will be more

- Luna's aging out of daycare, but that's in September

- We have a few good trips planned for '25

Some of the increase will be due to inflation, but most will come from lifestyle creep.

#YOLO ✌️

What I'm Working On...