Livin' La Vida Luna y Luca

We moved this week but had to stay in our old apartment for a few extra nights. We used a cardboard box as our dining table and slept on the floor.

It was glorious. Times like these put things in perspective. All I need in this life are my kids, my pizza, and someone to take a picture of the moment. 🤣

Selling Off

"If you're not choosing to sell & realize gains, you're choosing to buy at today's price".

"If you could start from scratch, would your portfolio look the same as it does today?"

These two heuristics have led me to make a semi-dramatic decision: I'm selling my rental properties.

I have partners on these assets so I had to make some concessions.

Philly Special

The first one up is the SFR in Philadelphia. We just listed it (again) after failing to sell it back in the Spring of 2023.

Because I'm forcing the sale of Project Catharine, I agreed to sell my 50% stake in the 4-family project in Philadelphia.

We just finished drywall so this project should finish in the next 3-4 months. I'll be able to get out at my cost-basis and leave any upside for my partner and his new partner on the deal.

7-Units in South Jersey

The Quad & Triplex in South Jersey are the first two rental properties I ever bought. I intended to hold them for the long term. The plan was to sell them when the kids went to college. But that ship sailed like 4 evictions ago.

Despite having 4% fixed rate debt and multiple 6-figures in equity, these two properties are incapable of generating cashflow, which is hella frustrating.

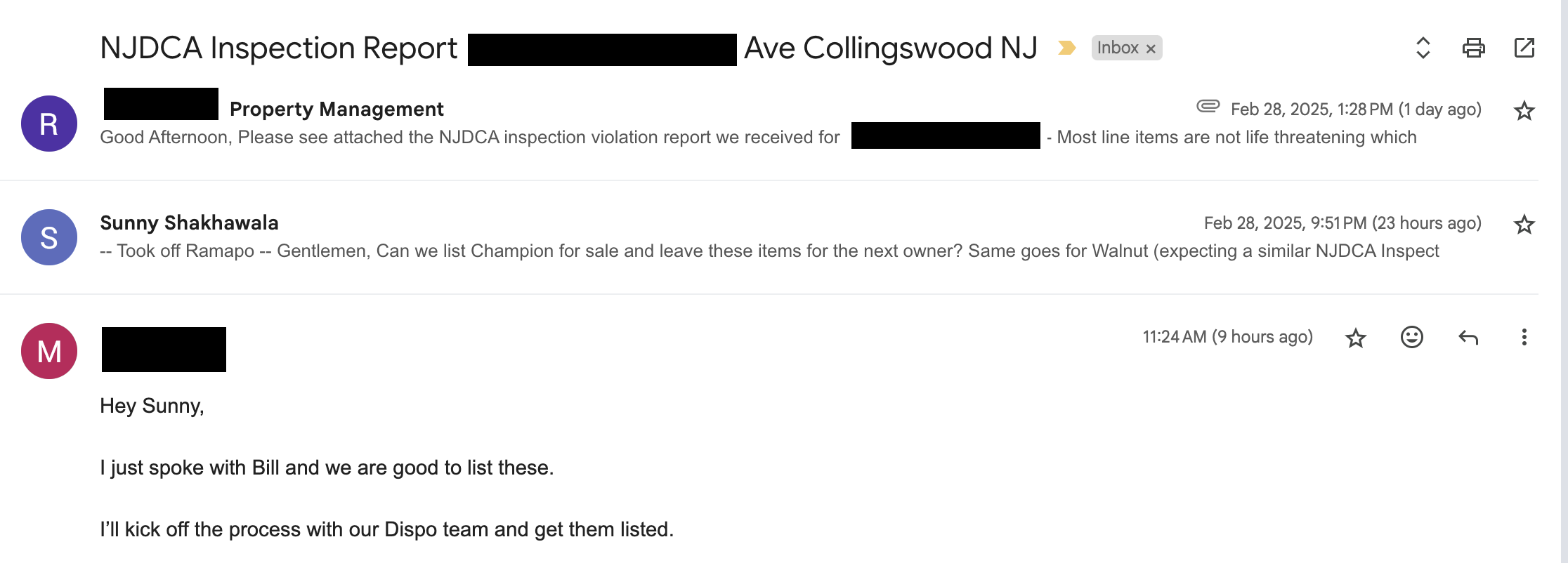

We also just had our NJDCA Inspection at the 4-unit and they sent us a laundry list of repairs we need to make. Hard pass.

I used this notification as an opportunity to shoot my shot with my partners on selling. Thankfully, they agreed. We'll be listing both properties in the next few weeks.

Why Sell?

Selling these properties is going to be an expensive endeavor. I'll have to pay prepayment penalties and depreciation recapture on 3 out of 4. We'll also pay 5-7% of total sales price in closing costs. And I'm sure there's something else I'm not considering.

But I'm fighting for simplicity. I don't want a ratpack of rental properties that scream slumlord. Nor do I want to be in the camp of people who pass down a problem portfolio to their children delusionally thinking I'm doing them a favor.

I'd rather have the money invested in the market and just compound at the rate of the SP500. Or use that money to develop more single family homes.

Speaking of which...stay tuned. Something's brewin'. 🍜

✌️

What I'm Working On...