Livin’ La Vida Luna

Here’s Luna sitting in a box full of her stuff.

PSA: We moved this week! Same building, different unit. If you keep our address, make sure to change the apartment number to 413.

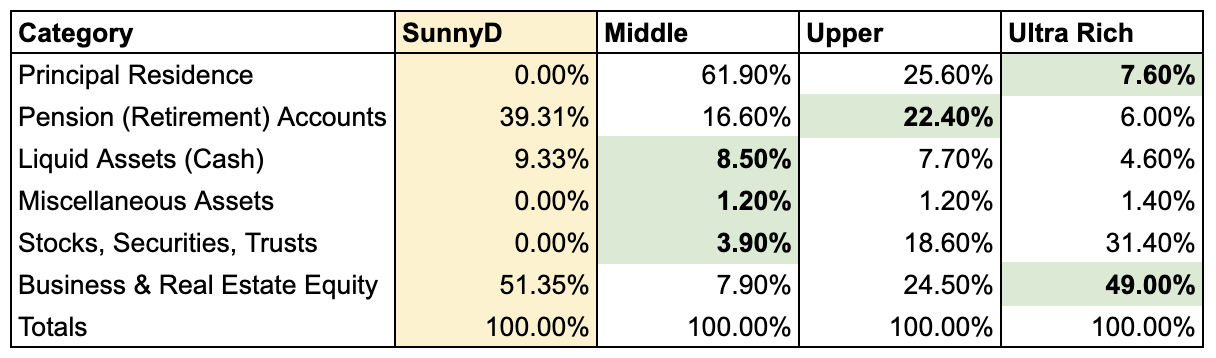

Comparing Our Net Worth to the Ultra-Rich

I found this infographic from a survey conducted by Edward N. Wolff back in 2017. It's called The Composition of Wealth.

Sidenote: The most right (ultra-rich) bar has a typo: 6.7% for liquid assets should read 4.6% as per actual study data (page 48).

Each bar accounts for 6 items as a % of net worth (NW):

- Principal (Primary) Residence

- Pension (Retirement) Accounts

- Liquid Assets (Cash & Equivalents)

- Miscellaneous Assets (Jewelry, Personal Loans to Friends & Family)

- Stocks, Securities, Mutual Funds, Trusts

- Business Interests & Real Estate Investment Equity

The 3 bars from left to right are:

- Middle Income (20th - 80th percentile) earners with a NW below $471K

- Upper Income (80th - 99th percentile) earners with a NW of $471 - 10.3M

- The Ultra Rich (top 1%) earners with a NW of $10.3M+

If you look at the chart, you can see there's almost an inverse relationship between the middle-class and ultra-rich in terms of % of net worth allocated to each line item.

For example, the middle class has the lion’s share (62%) of their net worth tied up in their primary residence, whereas the ultra-rich allocate less than 8% of their net worth to their primary home.

These stats aren't particularly surprising. If you look beneath the surface, it makes complete sense.

Takeaways:

The % of net worth allocated to primary residence goes down (dramatically) as income goes up. This is likely because there are diminishing returns associated with having a more expensive home. Do you need a $6,000,000 compound if a $700,000 colonial does the trick?

The ultra-rich gain their status by being involved in business. An outlier example would be Jeff Bezos. I'm sure 99.99% of his net worth is tied to his shares in Amazon.

There's a tipping point of income at which earners shift from investing in security (primary residence and pension) into inherently riskier ventures (taxable brokerage accounts, investment real estate, and businesses)

Looking at this chart got me thinking…

What Does Our Net Worth Look Like?

Here’s how we stack up when using the same categories:

We still don't own our primary residence so that's a big fat zero.

We max out our tax-advantaged retirement accounts every year so I'm not surprised it's such a large portion of our net worth.

Our cash position is 10% of our net worth, which is probably too high. However, we like the security of having 6+ months of operating capital in the bank.

According to the author of the survey, miscellaneous assets are, "Gold and other precious metals, royalties, jewelry, antiques, furs, loans to friends and relatives, future contracts, and miscellaneous assets." Yeah, we don't have any of that.

Nor do we have any stocks, securities, mutual funds, or trusts outside of our retirement accounts. I also don't imagine we ever will. Our priority is to max out tax-advantaged retirement accounts. Any extra funds are invested into the next category.

Business & Real Estate Investment Equity represents 50% of our net worth. This does NOT include my real estate investment company, which I essentially write down to zero because most of the equity in that asset is other people's money, not my own.

So what makes up the business portion of our net worth? It's mostly my advisor's shares on large multifamily projects. Getting a small 1-2% slice of equity on a $5,000,000 apartment building could be worth tens of thousands of dollars. Do that a few times over and the value really begins to jump off the page.

I also have a few angel investments in small businesses founded by friends. These will likely be written down to zero, which I knew going in. I'm just a sucker for supporting my team.

Moving Forward:

After looking at the break down of my net worth, I’ve decided to make some changes to our strategy.

First, I’d like to invest in more individual stocks. Right now, roughly 40% of our net worth is in retirement accounts (ROTH IRA, HSA, 401K). Of that 40%, 95% is in one Total Market Index Fund. The other 5% is in individual stocks. I want to slowly bring this individual stock number up to 20% of our portfolio.

Second, I think it’s high time to buy a primary residence. Dia has been incredibly patient with me on this front. Anytime we had enough cash in the bank to put a down payment towards a home for ourselves, I went out and found another rental property instead. I’m not even sorry.

Third, I want some exposure to miscellaneous assets. I’m not sure what this looks like yet, but Bitcoin, rare watches, and PSA graded sports cards are at the top of the list.

Finally, I want to build up my cash position even further. The latest round of stimulus was pathetic. $600 isn't keeping anybody from getting evicted, foreclosed on, or losing their business.

Here's the unfortunate reality: the time to buy is when there's blood in the streets. I'm looking for win-win deals with distressed sellers in 2021.

Tracking Net Worth

If you’re wondering how to track your net worth, I recommend using Personal Capital. I’ve been using this tool for years. I wrote about our process here.

Tracking your net worth is much easier and slightly more important than tracking your income and expenses.

It’s easier because there are only a handful of account balances to monitor periodically, whereas you may have a hundred or so transactions between income and expenses each month.

It’s slightly more important to track your net worth because it shows you the bigger picture. If you’re anything like me, you might be too busy “living in the spreadsheet”: analyzing every expense, trying to optimize for every penny spent.

If your net worth is growing steadily year over year, rest assured you’re on the right track.

In 2020, our net worth grew by 31%. At the same time, I probably told Dia we couldn’t afford the side of guac at Chipotle every single time we went. Basically, I’m asking you to do as I say, not as I do.